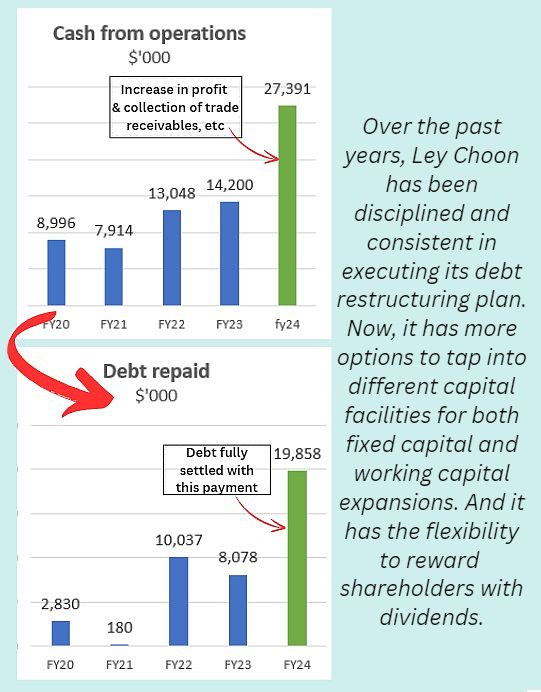

Executive Chairman & CEO of Ley Choon Group, Mr Toh Choo Huat: "With the completion of our debt restructuring agreement in March 2024, we now have greater flexibility over our capital management to grow the business further. We have also taken the opportunity to reward our shareholders with our first dividend payout since 2014.”

Executive Chairman & CEO of Ley Choon Group, Mr Toh Choo Huat: "With the completion of our debt restructuring agreement in March 2024, we now have greater flexibility over our capital management to grow the business further. We have also taken the opportunity to reward our shareholders with our first dividend payout since 2014.”

|

|

What a long run it has been, starting back in 2016 when Ley Choon entered into a debt restructuring agreement with its creditors.

The deal, which included selling off its non-core assets, was for Ley Choon to finish paying by 31 March 2021.

In 2021, in the midst of the Covid pandemic, Ley Choon successfully got its repayment deadline extended by 3 years.

As it approached that new deadline, it confidently responded to a shareholder question submitted for the 2023 AGM:

| "We are in the final leg of our debt restructuring agreement with our lenders. After the bullet repayment is made in the financial year ending 31 March 2024, we may be afforded more financial flexibility to grow the Company and barring any unforeseen circumstances, reward our Shareholders who have been loyal to us." |

Thus, with the release of its FY2024 results this week, Ley Choon lost no time to reward shareholders: It announced a dividend of 0.27 cent/share.

The implied yield is 4.6% based on a share price of 5.9 cents.

It's its very first dividend declaration since 2014.

Talking about share price ... following the company's announcement on 14 March 2024 that it had paid up its last outstanding debt, investors have bought up the stock.

It's gone up 50+% from 3.9 cents to 6 cents recently, giving the company a market cap of about S$90 million.

|

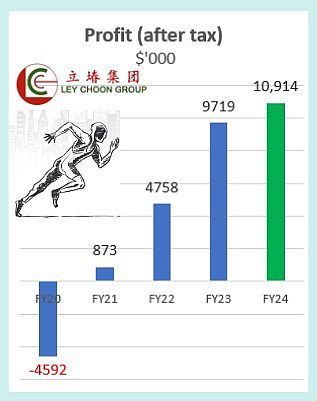

Details of the FY2024 results can be obtained in the company's announcement. Here are takeaways: Ley Choon reported a net profit of S$10.9 million for FY2024, an 18.1% year-on-year increase. As of March 31, 2024, Ley Choon Group's unfulfilled order book stood at S$258.5 million. This is expected to be recognized over the next 24 to 36 months. |

At approximately 8X historical earnings, Ley Choon stock is no longer going for a song (as it was, say, six months ag) but will re-rate further if the company clinches contracts that significantly balloons its orderbook.