Key takeaways:

| • Revenue rose 33.4% to S$123.9 million in FY2023 on the back of higher underground construction activities. (Its core business is laying of water pipes, high-pressure gas pipes, and high-voltage power cables, and rehabilitation of sewer pipelines. Majority of this work is in Singapore). • Robust order book value of S$315.9 million to be recognised over the next three years • Pared down borrowings sizably in FY2023, continues deleveraging efforts given the Group’s steady cash flow and strong order book visibility • Bidding for high-quality projects from a strong pool of opportunities available in the underground utility infrastructure space  Pipe jacking: New sewer tunnels, and utilities like water, gas, communication lines, etc are laid under roads. Pipe jacking: New sewer tunnels, and utilities like water, gas, communication lines, etc are laid under roads. |

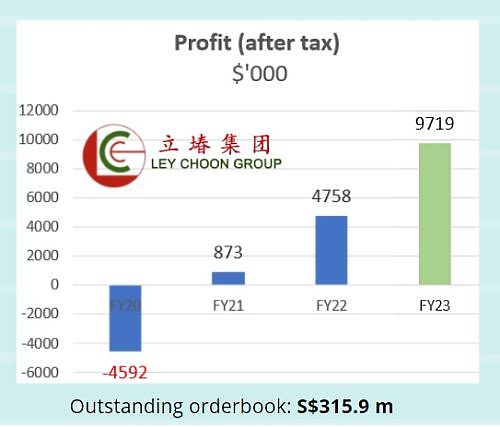

Turnaround story: Ley Choon has doubled its net profit in FY2023 with equal contributions from 1H and 2H.

Turnaround story: Ley Choon has doubled its net profit in FY2023 with equal contributions from 1H and 2H.

SGX Catalist-listed Ley Choon Group Holdings, a leading one-stop service provider for underground utility infrastructure construction and road works, enjoyed a rebound in construction activities during the financial year ended 31 March 2023 (“FY2023”).

• Gross profit margin expanded by 1.5 percentage points due to a favourable project mix and revenue growth. • Net profit doubled to S$9.7 million. • Total borrowings fell from S$27.9 million as of 31 March 2022 to S$19.9 million as of 31 March 2023, lowering Ley Choon’s debt-to-equity ratio from 0.7 times to 0.4 times. |

||||||||||||||||

Outlook

As of 31 March 2023, the Group had a total unbilled order book of S$315.9 million, which is around 2.5 times its FY2023 revenue.

Expected to be fulfilled over the next three years, the contracts provide Ley Choon with good mid-term earnings visibility.

Supported by steady cash flow and strong order book visibility, the Group said it will continue its deleveraging efforts in FY2024.

BCA projected that construction demand, which measures the value of contracts awarded, to range between S$27 billion and S$32 billion in 2023.

With the robust industry outlook, Ley Choon is expected to be a beneficiary given its strong market position in the underground utility infrastructure construction and road works space.

Ley Choon Executive Chairman & CEO Toh Choo Huat“Apart from new underground infrastructure, we also foresee a sizeable number of older infrastructures needing replacement soon. Ley Choon Executive Chairman & CEO Toh Choo Huat“Apart from new underground infrastructure, we also foresee a sizeable number of older infrastructures needing replacement soon. "In the coming year or so, we will capitalize on this uptrend and bid for more projects to replenish or even grow our order book further. “However, we will be prudent and selective with the projects we choose to participate in, taking into consideration working capital needs, manpower allocation, as well as managing the relatively higher raw material costs. "Ultimately, we want to steer the Group towards a sustainable growth path that will benefit shareholders in the long term.” |