|

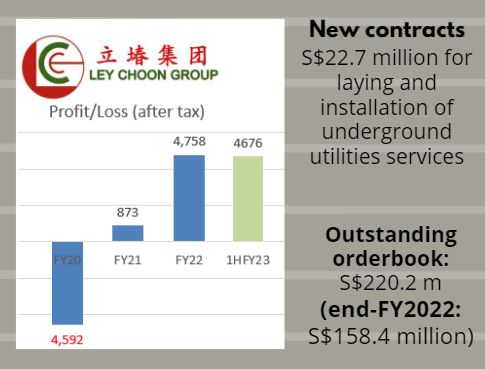

SGX Catalist-listed Ley Choon Group Holdings Limited (立堾集团控股有限公司) not only had stronger profitability in 1HFY23 (ended Sept 2022) but also enjoyed momentum in its orderbook growth.

|

|

Stock price |

1.8 c |

|

52-week range |

1.5 – 2.2 c |

|

PE (ttm) |

4.1 |

|

Market cap |

S$27.1 m |

|

Shares outstanding |

1.5 b |

|

Dividend |

-- |

|

1-year return |

12.5% |

|

Source: Yahoo! |

|

Ley Choon's customers include government bodies such as Public Utilities Board, Land Transport Authority, Housing and Development Board, Urban Redevelopment Authority, Building and Construction Authority, Jurong Town Corporation and companies such as Changi Airport Group and SP Group.

During 1HFY23, Ley Choon continued to pare down borrowings (S$25.5 million was outstanding, down from S$27.9 million as at end-March 2022) and lease liabilities.

This reduced finance costs by some S$0.5 million or 43.2% y-o-y to S$0.7 million despite rising interest rates.

Coupled with tight control of expenses, the Group reported 1HFY23 net profit of S$4.7 million (+ 31.7% y-o-y).

Mr Toh Choo Huat (卓沭橃), Executive Chairman and CEO of Ley Choon, commented: Mr Toh Choo Huat (卓沭橃), Executive Chairman and CEO of Ley Choon, commented:“Our growth momentum continues in 1HFY23. With the further easing of COVID-19 restrictions, our construction activities are gradually back to normal. "Infrastructure construction demand is ramping up and we, as one of the key players in the local market, won a few contracts recently. The new orders help further extend our revenue visibility to 2025." |