| • Underground, Singapore has a complex and extensive network of water pipes, high-pressure gas pipes, high-voltage power cables, fibre optic cables, sewer lines, etc. • Ley Choon Group is signaling that there is a large amount of work coming up over the next few years to renew such underground utilities. Ley Choon is well-placed to capture a good chunk of the replacement market. It is:

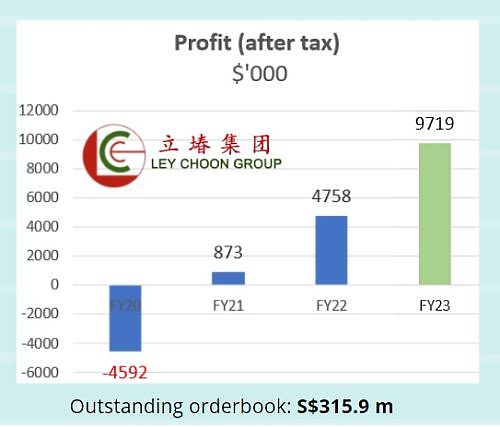

• Ley Choon, which has been enjoying rising profitability in recent years (chart below), is heading to the finishing line in repaying debt under a debt restructuring agreement signed in 2016. This debt is due to be fully settled by 31 March 2024, after which it regains the flexibility to pay dividends to shareholders. |

|||||||||||||||||

| Q:There's some optimism in the construction sector in Singapore as a result of reopening of the economy as well as the anticipated pipelines of projects from the HDB, infrastructure, commercial, industrial and oil & gas sectors. Do you think Ley Choon will also be a beneficiary? Please provide some colour on the opportunities and challenges for the company. |

A: Yes, the benefits from a vibrant construction sector will certainly trickle down to Ley Choon. New buildings will naturally boost demand for supporting infrastructure such as water pipes, cabling, and new roads.

| NEW CYCLE |

| "The country is also entering a replacement cycle for the underground infrastructure sector with many of the old infrastructure due for upgrading to cope with the larger population today. ... we certainly stand a good chance of winning some of these tenders." -- Ley Choon Group |

The country is also entering a replacement cycle for the underground infrastructure sector with many of the old infrastructure due for upgrading to cope with the larger population today. As one of the key players in the underground utility infrastructure segment, we certainly stand a good chance of winning some of these tenders.

With more projects available, we could face challenges in terms of workforce and equipment management. Logically, the more jobs we want to concurrently take on, the more engineers, workers, and equipment will be needed. It is a delicate balance as we want to avoid over-expanding given the cyclicality of the industry.

Hence, we will adopt a prudent and selective approach in our tender strategy, ensuring that we get higher-value contracts to maximise the utilisation of our resources.

| Q: What notable developments can shareholders expect from Ley Choon in the coming year(s)? |

A: As many of you may be aware, we are in the final leg of our debt restructuring agreement with our lenders.

| REWARDING SHAREHOLDERS |

| "After the bullet repayment is made in the financial year ending 31 March 2024, we may be afforded more financial flexibility to grow the Company and barring any unforeseen circumstances, reward our Shareholders who have been loyal to us." -- Ley Choon Group |

After the bullet repayment is made in the financial year ending 31 March 2024, we may be afforded more financial flexibility to grow the Company and barring any unforeseen circumstances, reward our Shareholders who have been loyal to us.

In addition, we announced on 6 February 2023 that we were also awarded contracts for road maintenance work early this year, our very first since 2015.

Given the longer-term nature of the contracts, the Group will have stronger earnings visibility and stability going forward.

| Q: What are the factors that are critical to Ley Choon’s success? What differentiates Ley Choon from competition? |

A: In a nutshell, we attribute our success to two key factors – vertical integration and digitalisation. We are a vertically integrated player with our own asphalt premix plant. Notably, we are one of the only three large-scale operators in the country.

The control over construction materials gives us greater flexibility when it comes to cost management for roadwork projects. Digitalisation, as we have elaborated earlier, gives us an edge in a more efficient deployment of assets and manpower.

We believe we are one of the early adopters in the industry when it comes to computerising our processes. Due to that, we are able to handle more projects with a relatively lean team, while still meeting deadlines consistently. Toh Choo Huat, executive chairman and CEO of Ley Choon Group, has an interest in 59.92% of the listco. NextInsight file photo

Toh Choo Huat, executive chairman and CEO of Ley Choon Group, has an interest in 59.92% of the listco. NextInsight file photo

| Q: What is Ley Choon’s value proposition to its shareholders and potential investors? What do you think investors may have overlooked about Ley Choon’s business? |

A: While investors are familiar with the opportunities in the new projects, they may not be aware that Singapore is entering a replacement cycle for underground utility infrastructure. A lot of the older pipes and cables are due for replacement to support the larger population size today.

Our position as one of the market leaders in the underground utilities infrastructure construction services segment puts us in a very favourable position to capitalise on this.

Full Q&A content is here.