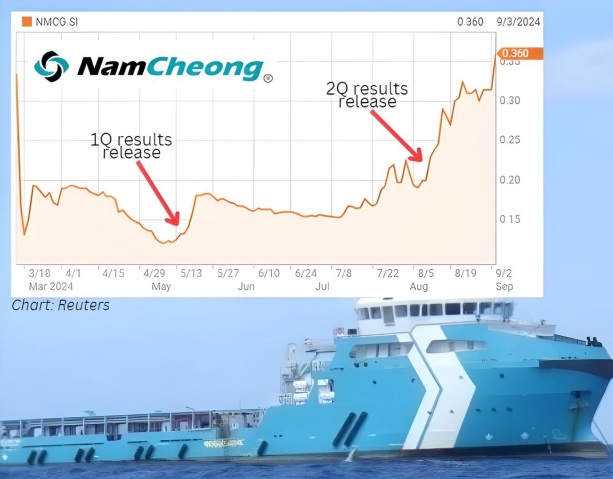

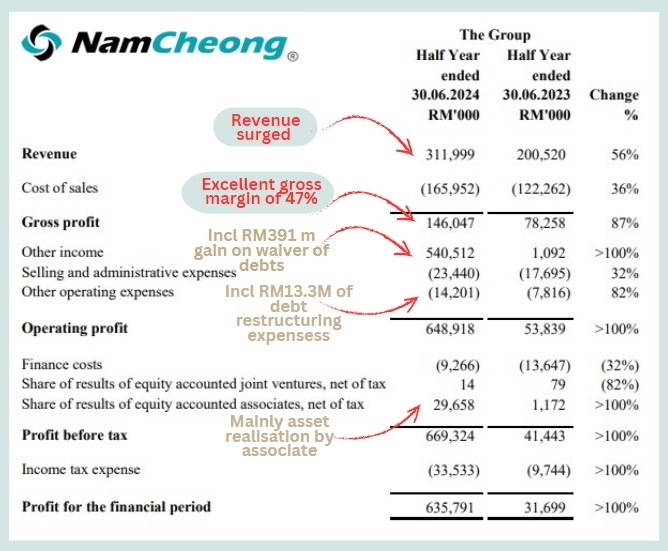

| Across the Causeway is a thriving oil & gas industry, where oil majors are busy producing and exploring for oil. The offshore support vessels (OSV) needed are in short supply, as a result of a lack of newbuilding after an oil crisis and during the pandemic, hence the elevated charter rates that owners now can command. That's evident in the profitabilities of various OSV companies listed on Bursa Malaysia. Over on the Singapore Exchange is one such company, Nam Cheong Ltd, which serves Malaysia's national oil company, Petronas, and several oil majors operating in Malaysian waters. Nam Cheong's stock came out of a trading suspension in March this year following a restructuring exercise that extinguished about half of its debt.  Two quarterly results so far this year have catalysed a re-rating of the stock. Two quarterly results so far this year have catalysed a re-rating of the stock. The stock has braved heavy selling by key creditor RHB Bank. To put it another way, keen investors (perhaps Malaysian fund managers) have absorbed the large volumes of stock sold by RHB and likely other creditors. (See also: NAM CHEONG: Will stock re-rate when creditor finishes selling down shares?) More recently, investors have re-rated the stock -- from 17 cents 2 months ago to 36 cents currently -- after its sterling 1H2024 results were released on 13 Aug 2024. The income statement contains a number of one-off items related to the restructuring, as highlighted in the graphic below:  |

It's no surprise to anyone keeping track of the OSV market that Nam Cheong said in its 1H2024 results release that it had experienced "improved daily charter rates and higher vessel utilisation of larger vessels".

Other OSV owners have been happily reporting the same news.

And Kenanga Research in Malaysia, which has been covering Bursa-listed Keyfield International, said in a Aug 2024 report:

| "KEYFIELD is currently in the peak season of the OSV market (typically 2Q and 3Q of the year), and we expect vessel utilisation to remain strong going into 3QFY24 .... Overall, we maintain that DCRs (daily charter rates) will continue to trend upwards in the local OSV market, as supply remains tight while client demand continues to increase." |

Nam Cheong in its 1H2024 results release holds the same outlook, and it cited a Business Times report:

"The rise in offshore activities, coupled with the tight supply of offshore support vessels, is expected to support the improvement in daily charter rates in 2025."  Nam Cheong, despite its 100% rise in the past 2 months, trades at quite a bit of discount to its peers in Bursa (see table).

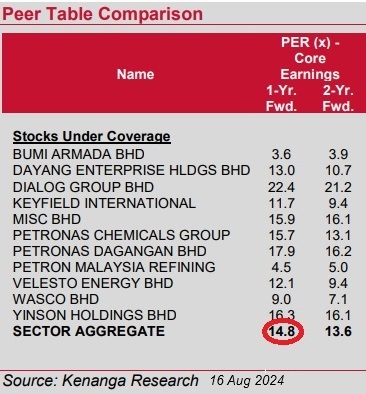

Nam Cheong, despite its 100% rise in the past 2 months, trades at quite a bit of discount to its peers in Bursa (see table).

Kenanga estimates their average PE at around 14X.

A back-of-the-envelope calculation indicates Nam Cheong trades at 2.8X this year's earnings (excluding one-offs).

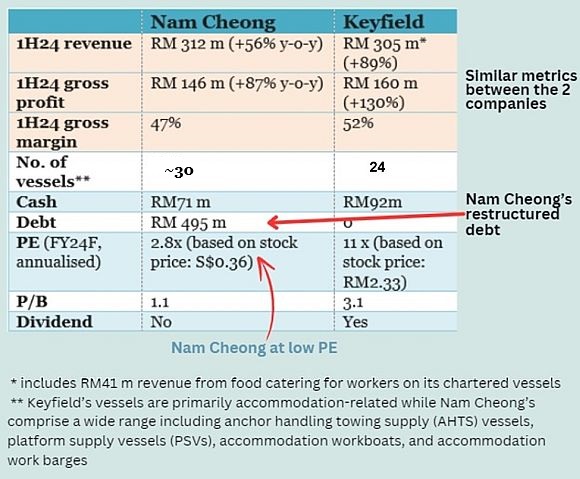

While many Bursa companies with OSV business in addition to other business segments, Keyfield Interntional is a good comparable to Nam Cheong as the former is also primarily an OSV owner.

Net profit estimate for Nam Cheong excluding one-offs (refer to first graphic on this article):

1H24: RM146 m - RM23.4 m - RM9.3 m = RM113.4 m

2H24F: Similarly but add in an extra quarter of finance cost = RM113.4 m - RM7.5 m = RM106.3 m

Total pre-tax: RM113.4 + RM106.3 = RM 219.7 m

After 24% corp tax = RM167 m

= S$50 m.

PE = 2.8x

Keyfield Interntional has a market cap of RM1.9 billion (or S$570 million) while Nam Cheong, S$142 million.

If Nam Cheong were to trade at Keyfield's PE ratio, its market cap would be similar to Keyfield's.

Nam Cheong, however, has certain negatives: It has RM500 m (S$150 m) debt which it has to repay as a first priority under the restructuring agreement, so no dividend can be declared.

Debt-free Keyfield, on the other hand, has been paying dividends.

2H2024 is expected to be just as buoyant for OSV companies, if not more, as daily charter rates are expected to rise, according to Kenanga.

Risks include a fall in oil prices, higher operating costs and a reduction in capex of oil majors.

Overall, the OSV market is expected to grow, driven by the increasing demand for energy and the expansion of offshore wind projects.