| Stocks turned positive in 4Q2023, spurred in part by the US Fed signalling that a surge in interest rates has abated. So we thought it'd be interesting to see which Singapore stocks have picked up pace in that quarter, which might hint of a momentum that can sustain into at least 1Q 2024.  We used a stock screener on the SGX website in search of stocks that have achieved at least a 20% gain over the past 13 weeks (ie Oct-Dec). For what it's worth, below is a list of some of them (excluding those with ultra low market caps or ultra low stock prices, among other things). |

|

Trading Name |

Last Price |

ROE % |

Mkt Cap ($M) |

Tot. Rev ($M) |

P/E |

Yield (%) |

13-wk %Pr. Chg. |

|

ManulifeReit USD |

0.08 |

-44.2 |

147.5 |

201.7 |

57.2 |

72.9 |

|

|

UGHealthcare |

0.167 |

-10.1 |

108.5 |

101.1 |

70.6 |

||

|

KepPacOakReitUSD |

0.375 |

3.5 |

349.9 |

149.8 |

11.0 |

15.8 |

55.8 |

|

Prime US ReitUSD |

0.24 |

-6.0 |

237.9 |

160.7 |

27.5 |

50.4 |

|

|

Yunnan Energy |

0.053 |

-8.5 |

220.4 |

282.3 |

45.5 |

||

|

Medtecs Intl |

0.186 |

-18.9 |

110.2 |

68.2 |

44.9 |

||

|

Amara |

0.6 |

1.8 |

346.2 |

107.1 |

53.5 |

0.8 |

44.6 |

|

Noel Gifts Intl |

0.28 |

0.7 |

27.7 |

18.5 |

122.7 |

39.5 |

|

|

OUE Com Reit |

0.285 |

7.7 |

1563.5 |

264.5 |

6.3 |

5.8 |

35.7 |

|

Sim Leisure |

0.51 |

28.7 |

86.3 |

27.6 |

13.4 |

2.9 |

35.1 |

|

IFAST |

8.21 |

7.1 |

2309.3 |

212.6 |

144.4 |

0.6 |

33.1 |

|

Alliance HC |

0.17 |

9.3 |

35.3 |

58.0 |

16.7 |

1.8 |

30.8 |

|

Geo Energy Res |

0.35 |

21.8 |

399.1 |

805.7 |

3.5 |

19.3 |

27.3 |

|

EliteComREIT GBP |

0.28 |

-10.8 |

144.9 |

39.7 |

13.3 |

22.5 |

|

|

Creative |

1.43 |

-24.5 |

106.8 |

74.9 |

22.4 |

||

|

Aspial Corp |

0.077 |

-9.2 |

177.4 |

537.4 |

3.2 |

21.5 |

|

|

Samurai 2K |

0.17 |

-11.1 |

57.1 |

19.5 |

21.4 |

||

|

ASL Marine |

0.064 |

21.4 |

43.5 |

356.6 |

2.9 |

20.0 |

|

|

LHT |

0.82 |

9.9 |

54.3 |

33.8 |

9.4 |

4.9 |

20.0 |

|

Source: SGX, 31 Dec 2023 |

|||||||

Some comments on some stocks:

• ManulifeReit: It invests in diversified office buildings in the US and has gone through a tumultous year.

In early 2023, the REIT breached its lenders' loan covenants. This led to the suspension of distributions and raised concerns about the REIT's financial viability.

The REIT has entered into a master restructuring plan, as announced on Dec 18, after all 12 lenders obtained the necessary approvals on the plan to raise funds through a mix of asset dispositions and a sponsor-lender loan.

The REIT rose 70+% in 4Q probably also because it's a bounce from oversold levels, considering that year-to-date the REIT is down 70+% (ie from 28 cents to 8 cents).

• UG Healthcare and Medtecs: Both these stocks sprang to life as Covid-19 infections surged.

Investors likely saw the potential of a rise in demand for the companies' gloves and other healthcare equipment. The buzz around the stocks has faded in recent days.

• Amara: Amethyst Assets, a special purpose vehicle majority owned by CEO Albert Teo and siblings (along with Dymon Asia Private Equity), made an offer to privatise the company at 60 cents a share.

| • Sim Leisure: This one has a lot of growth momentum in its business which has multiple attractions now compared to a single one -- Escape theme park in Penang -- during its IPO in 2019. That's why, compared to the IPO price of 22 cents, the stock has done exceptionally well, trading at the 50-cent level. But its valuation does not look cheap.  At 1,111 metres long, the sliding tube at Escape theme park in Penang has been officially recognised as the world's longest by Guinness World Records. At 1,111 metres long, the sliding tube at Escape theme park in Penang has been officially recognised as the world's longest by Guinness World Records.Check out our commentary in the article Which small caps shone in 2023? Which two gained ~100%? |

• iFAST: Its 3Q results cheered investors. Net profit increased 308.4% YoY to S$8.52 million. 9M2023 net profit rose 194.2% YoY to S$15.09 million.

iFast also issued a positive outlook, saying: "Going forward, the Group expects overall revenue and profitability to show marked improvements. The Group expects profitability in 2023 to be substantially better than in 2022, while the revenues and profitability in 2024 are expected to show robust growth compared to 2023."

The PE ratio, though, is looking very high.

| • Geo Energy: The stock climbed with an increase in coal prices and, more significantly, a large acquisition of a coal asset in Indonesia. (See: GEO ENERGY: Stock price rises on coal price upturn, M&A plan set to be voted on) The company recently delivered the first piece of good news from the recently acquired coal mine of PT Triaryani (TRA). It reported that it had sold its first export shipment of coal of 55,000 tonnes for US$3.2 million. There's a significant aspect of the sale that Geo Energy wanted to highlight.  TRA coal is one of the cleanest coals (5% ash, 0.3% sulphur) available in the thermal coal market. That's why the shipment fetched a small premium to the ICI4 index, instead of discounts (sometimes as high as double-digit percentages) seen in the past with coal from Geo Energy's other mines. |

• ASL Marine: Emerging out of troubled times, this company is showing potential of a turnaround. Its 1Q2024 turned in $3.3 million net profit (versus a large loss in the prior year) on higher revenue.

FY23 was profitable to the tune of $3.5 million. Notably, in 4QFY23 it raked in $10.7 million net profit.

Another positive sign: In Oct 2023, a substantial shareholder bought 51.5 million shares off Fidelity in a married deal at 5.1 cents per share, raising his share to 72.7% (deemed and direct interests).  One negative -- and it's a pretty big negative -- about ASL Marine is its debt burden.

One negative -- and it's a pretty big negative -- about ASL Marine is its debt burden.

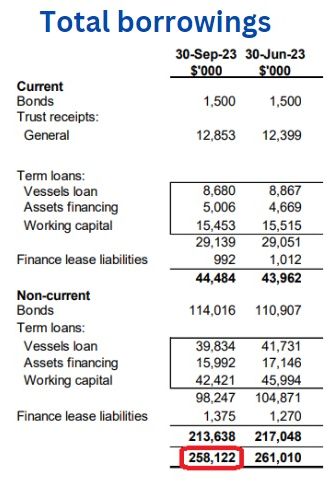

As at 30 September 2023, the Group’s total borrowings amounted to $258.1 million (see screenshot).

Finance costs gobbled up big chunks of operating profit.

Finance costs amounted to $6.9 million in 1QFY24 and $29 million in full-year FY23.