Investing in small caps comes with greater risks than investing in big caps but it's evident that the big percentage gainers in any given period are usually small caps. Trouble is, it's not easy to pick the winners consistently on the Singapore stock market. On the other hand, to no one's surprise, many other small caps deliver lousy returns. For what it's worth, below is a selection of mainly small caps that have shone this year. We used a stock screener on the SGX website, applying 2 criteria: the stock has achieved at least a 10% gain over the past 26 weeks and at least a 10% gain over the past 52 weeks. Having 2 sets of data (instead of 1) ....

|

|

Stock |

Last Price ($) |

ROE % |

Mkt Cap ($M) |

Tot. Rev ($M) |

P/E |

Yield (%) |

26-wk %Pr. Chg. |

52-wk %Pr. Chg. |

|

Aztech Gbl |

0.905 |

22.3 |

711.9 |

844.2 |

10.56 |

4.89 |

26.9 |

15.7 |

|

Centurion |

0.405 |

11 |

322.3 |

187.8 |

4.38 |

3.75 |

11.1 |

19.4 |

|

CH Offshore |

0.069 |

-16.3 |

54.5 |

23.5 |

|

|

20.3 |

71.1 |

|

ComfortDelGro |

1.38 |

5.0 |

3056.1 |

3783.2 |

23 |

3.3 |

24.8 |

16.0 |

|

Food Empire |

1.13 |

22.4 |

629.2 |

558.4 |

7.66 |

3.86 |

14.6 |

79.5 |

|

Frencken |

1.31 |

9.9 |

559.4 |

748.2 |

14.81 |

2.78 |

40.1 |

37.2 |

|

Ley Choon |

0.037 |

20.2 |

55.7 |

125.5 |

5.54 |

19.4 |

117.7 |

|

|

Mermaid Maritime |

0.097 |

4.8 |

130.4 |

337.8 |

12.65 |

33.3 |

16.5 |

|

|

Powermatic Data |

2.88 |

14.9 |

102.8 |

30.2 |

9.17 |

1.74 |

11.4 |

14.9 |

|

Riverstone |

0.705 |

10.2 |

1020.9 |

262.5 |

18.31 |

8.59 |

15.1 |

22.1 |

|

Sim Leisure |

0.52 |

28.7 |

86.3 |

27.6 |

13.38 |

2.88 |

60 |

96.213 |

|

Source: SGX |

||||||||

Some comments on some stocks:

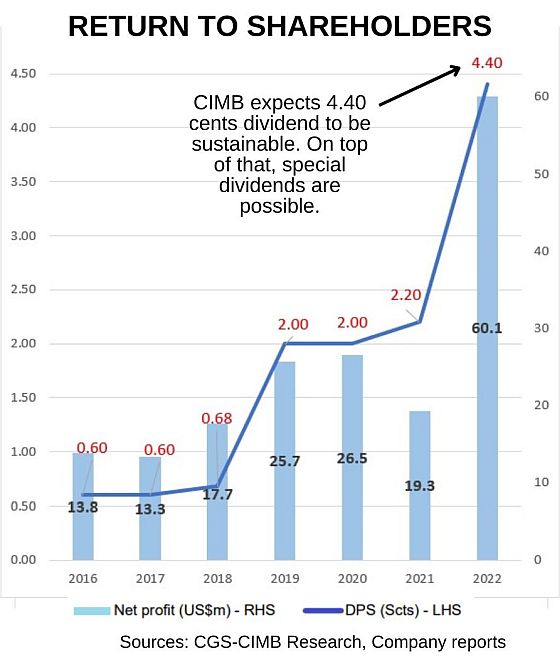

• Centurion: This company is riding on higher rental revisions and almost 100% occupancy for its accommodation for foreign workers in Singapore.

CIMB has a target price of 60 cents, which is 50% above the recent traded price.

A key reason for the upbeat forecast seems to be the upside revenue potential as rental contracts expire and are renewed.

CIMB says: "There remains a sizeable gap between Centurion’s average rent rates in 3Q23 and current market spot rate ..."

• ComfortDelGro: This is not a small-cap as its market cap is S$3 billion.

Its return to grace post-pandemic was expected as passenger volume normalised on its rail, taxi and bus services in Singapore and other parts of the world.

Fare increases helped too.

| • Food Empire: Its stock price was initially beaten down by high raw material prices and high freight costs because of supply chain disruptions during the pandemic and due to the war between Ukraine and Russia. Food Empire then raised selling prices of its coffee products, and margins not only were restored but expanded as input costs came down. At a PE of 8X, and with a record cashpile, the stock is said to be undervalued versus peers and, according to CIMB, a higher dividend payout is possible.  |

• Ley Choon: This specialist construction company had S$5.4 million profit in 1HFY2024 (ended Sept 2023) from road works, cable and gas pipe laying projects in Singapore.

On an annualised basis, the PE is about 5.

Its balance sheet is improving: Debt was down from S$19.9 million (end-Mar 2023) to S$10 million (end-Sept 2023). As a result, cash came down from S$7.6 million to S$4.7 million.

| • Powermatic Data: The market is definitely sleeping on this one, and has been for a long long time. The company was debt-free and had S$59 million cash as at end-Sept 2023 (ie, 59% of current market cap of S$101 million). On top of the cash, Powermatic's investment property in Harrison Road has been valued at $46.3 million in a Knight Frank's report dated 31 March 2023. Thus, cold cash and tangible real estate add up to a bit more than the market cap of Powermatic. No value is attributed to the operating business which has been consistently profitable -- it generated S$7.1 million net profit in 1HFY2024.  |

• Riverstone: It had a fantastic two years during the pandemic as its glove sales soared. After coming off in 2H2022, its recent 3Q2023 showed a strong recovery.

The glove industry has worked off inventory excess, raw material prices have softened and the current Covid wave is reminding investors that gloves are a key medical product.

• Sim Leisure: The 96% stock gain this year sends a message: This is one company to watch because of its potential for high growth in the years ahead.

Its key asset, the Escape theme park in Penang, has been drawing crowds post-pandemic along with its Escape Challenge indoor park at Paradigm Mall in Petaling Jaya and Kidzania Kuala Lumpur. Sim Choo Kheng, Founder & Executive Chairman: "We are in the business of fun. To us, the fun is measured in the number of smiles per hour. That is something I have specialised in over the past 33 years."The business generates high cashflow, just like its peer, Straco Corp.

Sim Choo Kheng, Founder & Executive Chairman: "We are in the business of fun. To us, the fun is measured in the number of smiles per hour. That is something I have specialised in over the past 33 years."The business generates high cashflow, just like its peer, Straco Corp.

But the stock is thinly traded as it's tightly held.

On an annualised basis, the PE is around 17.

1H2023 net profit: RM8.8 million which is S$2.5 million.

Note that 2H typically delivers stronger profit due to year-end holidays, so expect a higher-than-RM8.8 million profit.

In addition, there will be maiden revenue contributions from Escape Adventure Park in Ipoh, Perak in 4Q this year.

Opening next year:

• KidZania Singapore on Sentosa Island (1Q2024)

• Escape Challenge indoor parks in Alamanda Putrajaya and Paradigm Mall, Johor Baru.

• Haven Cinema Centres (offering virtual reality entertainment) in Singapore and Kuala Lumpur (2Q2024).