Chart: Reuters

Chart: Reuters

| The recent NextInsight article "This investor sells some shares after >3,000% gain. And tells a moving personal story", which is about an incredible investment in lithium explorer Liontown Resources in Australia, was a popular read. While such exploration success is not commonplace at all, it points to the bonanza that stocks of explorers will deliver when they find significant amounts of minerals. This has happened throughout the past, but the reward is particularly rich now with certain minerals. The global energy transition -- a once-in-a-lifetime changeover -- will require immense amounts of minerals such as lithium, nickel, copper and graphite. |

These minerals are needed in batteries for energy storage, electric vehicles, solar panels, and other clean energy technologies.

Benchmark Minerals Intelligence predicts:

|

High demand equals high prices for the commodities. It's simple economics. It's inevitable, according to analysts and market experts.

Australia is well-endowed with these minerals. Naturally, its stock exchange is home to hundreds of explorers searching for new deposits of these minerals.

How junior explorers do it: • Sample soil and rock chips to gauge the mineral content, • Grasp the geology and history of the land, and • Drill and analyse the cores, and drill further. • Based on incoming results, do a resource modeling to gauge the size and grade of the deposit. Their prize, if they get lucky: A major discovery worth hundreds of millions of dollars, even billions. Photo: Caspin Resources |

Of course, there is significant risk involved in investing in junior explorers. Risks include:

| • There is no guarantee that an explorer will find a commercially viable deposit of energy transition minerals. • Exploration takes lots of time, stretching to years to delineate a significant resource, if ever. • Explorers regularly raise funds for exploration, likely diluting existing shareholders. • Explorers operate in a variety of countries, some of which have unstable political environments. Political instability can lead to changes in exploration and mining regulations, corruption, and even violence. |

For those unfamiliar with mining and exploration, it's a steep uphill climb to understanding geology and learning to interpret drill results.

Explorer stocks can be notoriously volatile, so large (short-term or permanent) losses are not uncommon.

That said, for investors with a high risk tolerance and with deep pockets, investing in junior explorers could present a rare opportunity to participate in the energy transition via stock picks.

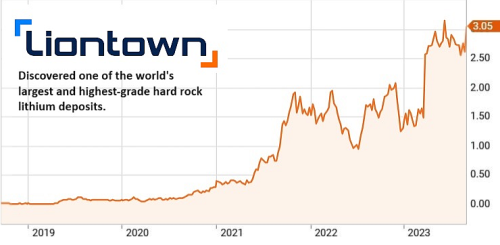

Liontown Resources' stock price went from less than 10 cents 5 years ago to $3.00 recently.

Such an extraordinary surge reflects the immensity of its discovery of lithium in Western Australia which culminated in a resource estimated at about 150 million tonnes, placing it among the top 10 in the world.

And again, it's the high demand for lithium that has propelled its market price up in recent years. The same supply-demand dynamics are set to play out for other minerals needed for the energy transition.

But, wait, haven't they been on a downturn this year? And haven't junior explorer stocks been caught in the downdraft?

Demand for commodities such as copper has been weak, chiefly because of a weaker-than-expected Chinese economy post-Covid as well as inflationary pressures hitting consumers globally.

Will this be temporary? Likely.

Though in its nascent phase, electric vehicle sales are rising exponentially globally as is the transition to renewable energy such as solar, wind and hydro.

The table below is illustrative of how stocks of explorers and miners progress in their market valuation as their fundamental value increases:

|

Company |

Briefly … |

Market cap |

|

• Just made “groundbreaking” discovery of rare earth elements in Western Australia. |

~A$16 m |

|

|

• Exploring for copper in USA, resource so far 11.4 million tonnes of 4.1% copper equivalent. |

~ A$70 m |

|

|

• Lithium in brine lakes in Argentina. Resource so far 7.3 million tonnes of lithium carbonate equivalent @ 852 mg/l. |

~ A$208 m |

|

|

• Company reckons its grounds have potential to host an immense 100 – 240 million tonnes of lithium oxide grading at 1.0 – 1.5% grade. |

~ A$1.1 b |

|

|

• It's producing spodumene concentrate from its Aussie mine, which is the largest independent hard-rock lithium operation in the world, with an estimated mine life of 34 years |

~A$12.5 b |

|

|

|

||

| See also: Eye on green energy metals: Will this junior explorer hit it big? Here are early drilling results |