Chart: Reuters

Chart: Reuters

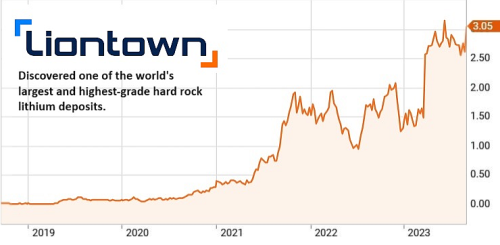

| • Below is a moving personal story by "Goldilocks", an Aussie shareholder of Liontown Resources (LTR), an Australian-listed explorer of lithium which has been hitting the headlines this year. • Liontown is currently the subject of a takeover offer valuing the company at A$6.6 billion. Its stock has soared from 10 cents at the start of 2020 to $3.05 recently. • "Goldilocks" shared his investing and personal journey on Hotcopper forum today -- it's a story of grit and a buy-and-hold strategy that worked superbly. And a reward that made the long investment timeline worthwhile. • He was triggered to make his post following another investor's post that cast some aspersion on "Goldilocks" partial sale of his Liontown shareholding. |

I don't know how to take your post. It has upset me but I'm not sure if that was your intention.

You seem to have used my selling some shares today and twisted it into something bad.

I am 60 next year and spent my whole life in debt and working very hard to be financially independent one day.

| I love this company and agree with you that this whole experience is not just about money. However, I feel I have given a lot to many people throughout my life and hardly ever taken anything for myself, so please let me enjoy this small moment. |

I was educated in the public school system in the country, both my parents never finished high school. I only remember one person in my school ever making it into medicine and that was someone who did year 12 twice. I worked my way through science, then did an honours year, before gaining entry into medicine.

I found the pace of medicine very hard after science, but I still somehow graduated with honours, and after spending a couple of years at one of Sydney's top hospitals was accepted into a specialist training program at one of Melbourne's top hospitals.

The training program was 5 years, but it took me 6 years as I took three goes to get through the final exam. All up it took 17 years from starting Uni to finishing speciality training. I stayed on the staff there for a couple of years, was asked to join them as a partner, but turned them down as I saw myself more as a practising specialist rather then an academic. I moved to country NSW with my new wife and joined a practice.

Not long afterwards my first born child came along, but was diagnosed with a disability requiring us to move back to Melbourne for intervention. I didn't want to go straight back into private practice in Melbourne, so I completed a second specialty, fortunately only a further two years, and this gave me opportunity to be around more during the early intervention.

Around this time I borrowed a lot of money, around 2mil, and invested the lot in the stock market, believing my son might never be independent, and I was trying to safeguard his future.

I lost just about everything in the fallout of GFC. On top of that, I spent 1-2mil on my son's intervention as I wanted him to have every possible chance. So even though I had a good paying job, I was severely in debt and the only thing I could do was work myself to the bone.

My bank called me in one day around 2016. They basically shook their heads at me in front of my wife and said that I had been wreckless with my investments.

They said I would never be able to write off my losses no matter how long I lived. They wanted me to hand over what was left of my portfolio, including LTR shares, and let them manage it. It was an absolute low point in my life, and I was particularly embarrassed in front of my wife, but I refused to hand over my shares to them.

I first bought LTR in 2007 and my first sale of shares was this year at $2.50. That sale will cover the loan on our home, which we bought 3 years ago but has been rented out ever since as we needed the rent to help cover the costs of the loan. All our wealth has tied up in LTR for a very long time. We will finally get to move into that home in December after I retire.

The sale of shares today is so I can draw an income from my investments in retirement and put my kids through the rest of their education. I am still holding 60% of my shares, which is a respectable holding.

I love this company and agree with you that this whole experience is not just about money. However, I feel I have given a lot to many people throughout my life and hardly ever taken anything for myself, so please let me enjoy this small moment. Taking some profit does not mean I am selling out this company or this Country. Let's be reasonable.

If it comes to a vote, I will vote we keep the asset Australian and we go mining.

| Since the above post, "Goldilocks" has made 2 more that add more colour to his investing and life journey. Check out: post #69793747 and post # 69794377 |