• For investors, what presents an enormous reward potential? A possible answer: Exploration of commodities such as oil and lithium.

• Over the course of weeks or months, emerging results may point to whether significant discoveries have been made that have "transformative potential" for RH Petrogas, as the company has flagged. • Not familiar with RH Petrogas? Below are excerpts from a recent SGX article to get you started. |

||||||||||||||||||

Company Overview

RH Petrogas (RHP) is an independent upstream oil and gas company headquartered in Singapore. RHP is the operator of 2 production sharing contracts (PSCs) – the Kepala Burung PSC and the Salawati PSC and operates across the full range of upstream activities covering the exploration, development and production of oil and gas resources. The 2 contiguous blocks are located in the ‘Bird’s Head’ area in the Salawati basin, a prolific petroleum basin in West Papua, Indonesia. Link to Stock Screener company page. Inset: CEO Francis Chang

Inset: CEO Francis Chang

| Describe RH Petrogas' recent financial performance. |

The Group's revenue is derived from the sale of oil and gas produced from its 2 PSCs. With the strong recovery in crude oil benchmark prices that began in 2021, the Group recorded significant increases in revenue from FY2020 to FY2022.

With an average realised oil price of US$95 per barrel in FY2022, the Group achieved a record revenue of US$104.9 million and EBITDAX (earnings before interest, tax, depreciation, amortisation, exploration expenses, impairment and other non-recurring items) of US$95.0 million that year.

The Group recorded revenue of US$43.0 million for the half year period ended 30 June 2023 (1H 2023), a decrease of 24.1% year-on-year.

This was mainly attributable to a 25.5% decrease in the average realised oil price per barrel over the same period. The Group's cost of sales increased by 17.1% year-on-year, due to higher field operating expenses. The Group recorded a net profit of US$3.1 million and EBITDAX of US$7.6 million for 1H 2023.

Additionally, the Group recorded positive operating cash flows of US$11.6 million for 1H 2023 and had cash and cash balances of US$64.4 million as at 30 June 2023.

The Group expects oil demand and prices to remain supported by the expected easing of interest rate hikes and improving global economic prospects.

| What are some key drivers or trends for the oil and gas market? |

The oil and gas market is cyclical in nature. While the Group has offtakers in close proximity for its produced oil and gas, selling prices are ultimately correlated to global benchmark prices.

| "Due to prolonged underinvestment in exploration and production since 2015, excess global production capacity remains limited. OPEC's most recent forecast is for oil demand to continue to grow for the rest of 2023 and into 2024, despite economic headwinds." |

All of the Group's oil and gas production is currently sold within Indonesia, which has set a target of increasing domestic oil lifting to 1 million barrels per day by 2030. Against this backdrop, the Group expects resilient demand for energy to power the nation's growing economy.

Selling prices for oil may experience periods of volatility due to short term supply-demand imbalances, geopolitical tensions and economic uncertainties. However, due to the prolonged underinvestment in exploration and production since 2015, excess global production capacity remains limited.

OPEC's most recent forecast is for oil demand to continue to grow for the rest of 2023 and into 2024, despite economic headwinds. The Group believes these factors will help to underpin global oil prices.

| Could you elaborate on the future direction for the Group’s various business segments? |

Currently, crude oil sales make-up over 80% of the Group’s revenue. In the longer term, the Group expects that gas will make-up an increasingly larger share if its exploration efforts pay off.

Looking forward, the Group is focused on increasing gas exploration and production. This is in line with expectations that natural gas will be a transition fuel as the world moves towards cleaner energy, consistent with scenarios modelled by organisations such as the IEA (International Energy Agency).

Natural gas is expected to still make up a significant portion of the global energy mix under all its scenarios, including the most aggressive assumptions of a rapid take-up of renewable energy.

| "The Group’s 2023 exploration plan includes the drilling of 1 high impact deep gas prospect. If successful, the Group would have enough gas production capacity to supply the needs of IGNITE Ecopark." |

In early 2023, RH Petrogas’ subsidiaries signed memorandums of understanding for the utilisation of natural gas from the Group’s assets to meet the energy needs of an upcoming project, the IGNITE (Indonesia Green Nickel Technology) Ecopark.

This project is a proposed integrated class 1 nickel processing park which is to be constructed in the locale of the Group’s Kepala Burung PSC.

The Group’s 2023 exploration plan includes the drilling of 1 high impact deep gas prospect. If successful, the Group would have enough gas production capacity to supply the needs of IGNITE Ecopark.

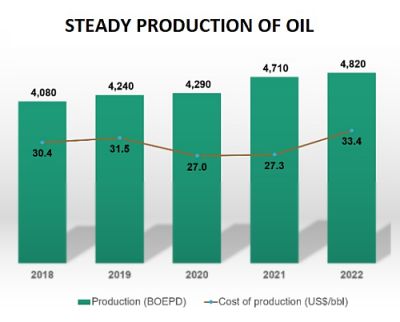

In the meantime, the Group continues to maintain steady production through the management of its existing fields, while working to identify and mature exploration prospects within the 2 PSCs.

The Group has a track record of maintaining steady production from its 2 assets despite the natural decline of mature fields. The Group currently has no debt, with cash holdings of US$64.4 million as at 30 June 2023. |

The above content is excerpted from SGX website. For the full article, click here.

See also UOB KH analyst report on RH Petrogas.