|

RHB Research has just released its 15th Singapore Small Cap Jewels report, which is essentially its top 20 picks for the year.

|

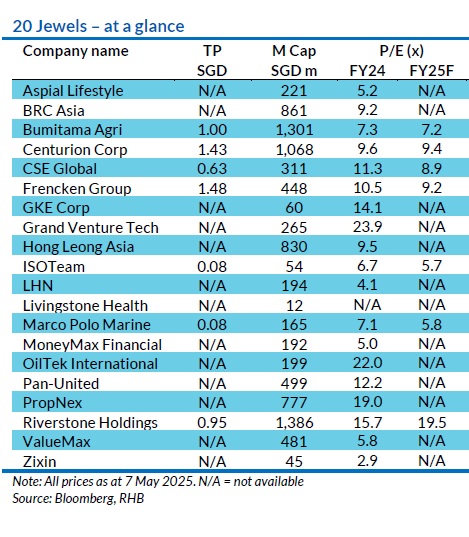

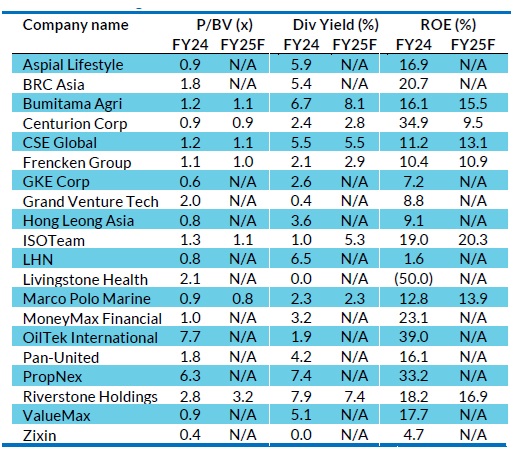

Out of the 20 "jewels" here are five that shine across valuation, yield and profitability metrics.

| Zixin: The Value Play |

Trading at 6× FY25F (ended March 2025) earnings, Zixin is arguably inexpensive, especially considering that earnings growth is expected to continue in the current FY26.

Trading at 6× FY25F (ended March 2025) earnings, Zixin is arguably inexpensive, especially considering that earnings growth is expected to continue in the current FY26.

But this China-based agri-tech company doesn’t pay a dividend, and its low single-digit ROE is, well, nothing to shout about.

Its core snack-producing business and the fresh produce segment centre around sweet potatoes.

The Group is quietly churning out good returns and could see a rerating if management’s expansion into new niches pays off.

RHB analyst Alfie Yeo said:

• Expect higher volume sales and better margins going forward.

• New revenue streams from high-technology manufacturing facility and feed ingredients.

• More land for sweet potato cultivation and sale over the longer term

| Hong Leong Asia: Twin Engines of Growth |

Hong Leong Asia trades at just 9.5× last year's earnings and 0.8× book value, which is a bargain -- even before you factor in net cash of SGD431 million (that’s roughly 50% of its market cap) sitting on the balance sheet.

You also get a rising dividend (3 SG cents, or ~3.6% yield).

What really powers HLA are its “twin engines”:

• Powertrain Solutions: Through China Yuchai, HLA sold SGD3.5 billion of engines in 2024.

• Building Materials: Its ASEAN cement, ready-mix concrete and precast arm brought in SGD682 million in revenue --- right as Singapore and Malaysia crank up construction on projects like Changi T5, Marina Bay Sands expansion, Johor–Singapore Special Economic Zone and new MRT lines.

All told, group revenue hit SGD4.25 billion in 2024, with recurring net profit surging 35% to SGD87.8 million.

With a rock-solid net-cash position, improving ROE and hefty growth catalysts in both China and ASEAN, HLA looks like the kind of small-cap stalwart that can surprise on the upside.

| Oiltek: The ROE Beast |

Oiltek CEO Henry YongOiltek stands alone with a blistering 39.0% ROE for FY24 -- making it the profitability king of the lot.

Oiltek CEO Henry YongOiltek stands alone with a blistering 39.0% ROE for FY24 -- making it the profitability king of the lot.

Sure, on its recent 61 cents stock price, a 29× P/E and 10× P/B look rich compared to the rest, and the 1.4% dividend yield is modest.

But this engineering specialist in edible-oil plants commands premium margins, backed by strong order visibility (~RM373 million as at 15 May 2025).

| PropNex: The Real-Estate Yield King |

Mohd Gafoor, CEO of PropNexThis is Singapore's largest listed real estate agency with over 13,000 real estate salespersons.

Mohd Gafoor, CEO of PropNexThis is Singapore's largest listed real estate agency with over 13,000 real estate salespersons.

It is sitting on a cash pile of SGD112m, with no debt and minimal capex requirements.

PropNex offered a 7.4% yield, which pairs with an apparently high 19.0× P/E and a 6.3× P/B.

What justifies the multiple is a stellar 33.2% ROE and a business model that scales with every home sale in Singapore.

As the market for new launches and resales keeps chugging along, PropNex converts every deal into commission revenue -- and then sends much of it to shareholders.

"Management has alluded to the possibility of paying additional special dividends in FY25, in conjunction with its 25th anniversary," said RHB analyst Vijay Natarajan.

If steady, high-yield income is your game, this is the name.

| Centurion: The Mid-Cap ROE Powerhouse |

Centurion CEO Kong Chee MinCenturion Corp straddles the property and hospitality worlds, delivering a massive 34.9% ROE in FY24 at just 9.6× P/E and 0.9× P/B.

Centurion CEO Kong Chee MinCenturion Corp straddles the property and hospitality worlds, delivering a massive 34.9% ROE in FY24 at just 9.6× P/E and 0.9× P/B.

While its 2.4% dividend yield isn’t headline-grabbing, the potential spin-off of its dorm-and-hotel assets into a REIT could unlock hidden value.

It’s a small-cap story where balance-sheet strength meets event-driven upside.

| Wrap-Up Singapore’s small-cap stage sure has something for retail investors. From deep value in Zixin and growth drivers in Hong Leong Asia, to outright yield monsters at PropNex and event-driven upside at Centurion, plus a pure profitability play in Oiltek, there’s a little something for every investor style. These are just five picks. For the rest of the RHB "jewels", click here for the report. |