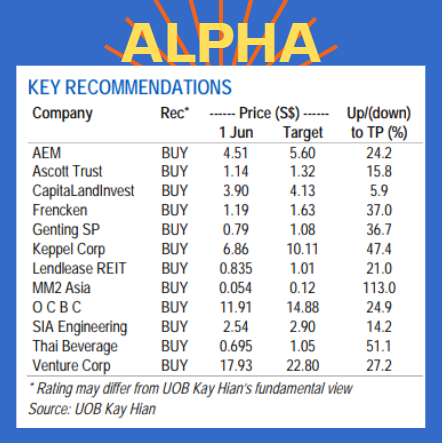

Excerpts from UOB KH report

Alpha Picks: Add Frencken And Lendlease REIT,

Remove Singtel And Singpost

| Our Alpha Picks outperformed the STI by 0.8ppt in May 22, declining by 2.9% mom vs the STI’s decline of 3.7%. For Jun 22, we add Frencken due to its attractive valuations and Lendlease REIT due to its organic growth from its new asset Jem. We have removed Singpost due to persistently high air freight rates. In addition, we have taken profit on SingTel as it has been a solid contributor to our portfolio performance.  |

WHAT’S NEW

• Outperforming in May. Although our Alpha Picks portfolio fell 2.9% mom in May 22, it nevertheless outperformed the STI’s 3.7% decline. Key stocks that outperformed for us were Venture (+7.4% mom), Thai Bev (+2.3%) and Keppel (+0.3%) while mm2 (-13.8% mom) and Singtel (-6.5%) underperformed.

• Adding Frencken and Lendlease REIT. For June, we add Frencken as we view its current valuations as being inexpensive, trading at 2022E PE and EV/EBITDA of 7.5x and 3.4x respectively along with a prospective 4% yield.

Lendlease REIT has been added as we like its organic growth from its new asset Jem, as well as its exposure to sequentially higher tourist arrivals which will benefit its Orchard Road asset.

• Taking out Singtel and Singpost. We have taken profit on Singtel as it has done well for us, up 5% since inception into our portfolio. While we remain bullish on Singpost in the medium term, we have removed it as air freight rates have not shown signs of dropping and appear to remain elevated instead in the near term.

| AEM Holdings – BUY • System-in-Package design shift to revolutionise semiconductor manufacturing. Key customer Intel Corporation’s (Intel) March IDM 2.0 strategy is a major bet that future demand and profitability lie in the packaging of modular dies (or chips), known as “tiles”, which can squeeze more compute within a single package. Driving towards that goal, Intel intends to build new fabrication plants (fabs) for these new “tiled” chips, and is expected to outsource the production of certain modules. Existing capacity has also been earmarked for the foundry services market.  • Sustained demand for AEM’s total portfolio. Intel’s decision to maintain old fabs and build new ones means that AEM will enjoy: a) steady demand for its consumables and services, b) recurring but cyclical demand for equipment upgrades at Intel’s old fabs, and c) demand for new equipment to test the new “tiled” chip products. That said, AEM provides mainly backend test equipment, where demand typically comes 6-9 months following the installation of front-end equipment at the new fabs. Additionally, management expects engagements with 10 of the top 20 global semiconductor companies to result in meaningful revenue contributions in 2H22 and beyond.

• Maintain BUY. We value the company at S$5.60/share, implying 15.6x 2022F earnings. Our valuation is at a premium to the Singapore peer average forward PE of 10.1x. More direct competitors listed in the US and Japan trade at an average of 18.8x forward earnings. SHARE PRICE CATALYST • Events: a) Higher-than-expected revenue growth rates, b) better-than-expected cost management, and c) earlier-than-expected integration synergies with CEI. • Timeline: 6+ months. |

Full report here.