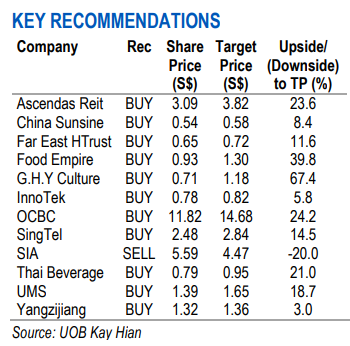

Excerpts from UOB KH report

Alpha Picks: Adding UMS, Removing Frencken  Our portfolio gained 5.2% mom in Mar 21 but was outdone by the STI’s gain of 7.3% mom due to strong share price performance by the Jardine companies. Our portfolio gained 5.2% mom in Mar 21 but was outdone by the STI’s gain of 7.3% mom due to strong share price performance by the Jardine companies.Notable outperformers for Mar 21 included Yangzijiang (+19.6% mom), Frencken (+13.3% mom) and Far East Hospitality Trust (+10.5% mom) while GHY (-3.4% mom) and our short call on SIA (+11.4% mom) worked against us. For Apr 21, we add UMS while removing Frencken. |

China Sunsine chairman Xu Chengqiu.The bottom line benefitted from the expansion of the gross profit margin to 27.8% (2H19: 22.9%, 1H20: 23.2%), as well as tight cost control measures. China Sunsine chairman Xu Chengqiu.The bottom line benefitted from the expansion of the gross profit margin to 27.8% (2H19: 22.9%, 1H20: 23.2%), as well as tight cost control measures. This brought 2020 net profit to Rmb218.8m (-43.9%), 7% above our estimate. Sunsine maintained its final DPS of 1 S cent. • Gaining from higher capacity and elevated ASPs. The good set of results was attributed to management’s perseverance with continued investments to expand capacity over the past few years, despite the downward trend in rubber accelerator prices. The move is now paying off, with market share for Sunsine more entrenched, alongside rising demand for new vehicles in China. Furthermore, the ASP of rubber accelerators, the main earnings driver for Sunsine, has continued to gain ground, in tandem with aniline, the major feedstock for rubber accelerators, due to higher crude oil prices. The average price of aniline has risen an estimated 17% qtd as at 25 Feb 21 to Rmb8,372/tonne, a 29% sequential increase over 4Q20’s average. • Good proxy for China’s recovering auto sector. Sunsine derives the bulk of its sales from China (2020: 69%, 2019: 61%), which has been strengthening since Mar 20. The Chinese economy is seeing robust growth due to government stimulus measures. • Maintain BUY with an unchanged target price of S$0.58. We keep our valuation peg at 3.5x EV/EBITDA, +1SD of its 5-year average. The target price implies a 2021F PE of 9.6x and ex-cash of 4.1x. This represents a steep discount to larger peers, which are trading at 7.7x forward EV/EBITDA and 15.3x 2021F PE. |

This was mainly carried out in 4Q20 and Jan 20 where FEH bought back a total of around 3.0m shares for a consideration of about S$2.0m, potentially signalling a strong confidence in its 2021 business outlook. • Compelling valuation. Food Empire trades at an undemanding valuation of 11x 2021F PE, a significant discount to peers’ average of about 25x 2021F PE despite its growing presence in the Vietnam market and leading position in its core markets in Eastern Europe. • 2020 earnings growth amid COVID-19 pandemic reflects resilient product offering and strong brand equity. Given the low price, relatively inelastic and consumer-staple nature of its products, Food Empire is likely to be more resilient and sheltered from an economic slowdown, in our view. Additionally, we highlight that in spite of the weaker ruble against the US dollar, the group has managed to mitigate some of the adverse impact on the bottom-line through ASP hikes and cost management. We are encouraged by the group’s core earnings (ex foreign exchange) growth in 2020 at 14% yoy despite stringent lockdowns in 2Q20. We believe this is a testament to its strong brand equity in its core markets that have been developed over many years. Share Price Catalysts • Events: Stronger-than-expected recovery in volume consumption and improvement in operating leverage. • Potential takeover target given its attractive valuation and distribution network. • Timeline: 3-6 months. |

Full report here.