Excerpts from KGI Research report

Analyst: Joel Ng

| Significantly undervalued amid the ongoing bulk shipping upcycle • Strength to strength. UAG reported FY2021 net profit of US$18mn, the highest since its IPO. This was on the back of a decade-high charter rates for bulk carriers.

As a result of the stellar results and stronger balance sheet, the group is proposing a final dividend of S$0.03 and a S$0.02 special dividend, bringing the total year-end dividend to S$0.05 (Ex-div 19 May 2022). • Maintain Outperform while raising our TP to S$1.66. Despite the 100% rally of its shares over the past year, UAG’s valuations remain attractive amid the stronger-than-expected bulk carrier upcycle. Our TP implies a very conservative 0.67x FY2022F P/B, which is more than 30% discount to int’l peers who are trading >1.0x P/B. |

||||

FY2022 review. UAG reported a FY2021 net profit of US$18.0mn, a significant turnaround from the US$7.5mn loss in FY2020, and the highest profit since its IPO in 2007.

The stellar performance was on the back of FY2021 total revenue surging 51% YoY to US$69.4mn, driven by higher charter income and the sale of properties under development.

Net gearing improved to 0.63x as at end Dec-2021 from 0.95x as at end Dec-2020. NAV increased to US$1.69 as at end Dec2021, or equivalent to S$2.25 based on 1.33 USD/SGD.

The group will be rewarding shareholders with a total dividend of 5.0 sing cents (comprising 3.0 final and 2.0 special) for 2H2021, which in addition to the 2.0 sing cents interim dividend, marks the highest dividend in 10 years.

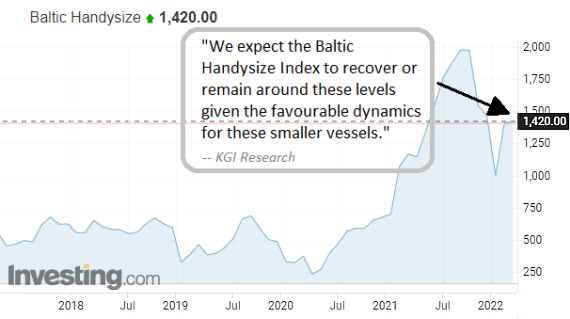

Smaller vessels are still in hot demand. The Baltic Handysize Index (BHI) dropped by 50% from October 2021 to January 2022 but rebounded by more than 40% since the start of February 2022.

Even then, BHI at where it stands now is still at levels that are more than double the average rates seen over the past 10 years as demand for smaller vessels have continued to find support amid an already stretched global supply chain.

Eight of UAG’s wholly-owned dry bulks will renew in 2022, and another two in 1Q2023 (Figure 4).

Unlike previous rounds of bull markets in the handysize dry bulk shipping market, this upcycle seems more robust given the better dynamics in the market.

HK and Japan business update. In our last report dated 22 Nov 2021, we had expected UAG’s five HK commercial properties to begin contributing from 2H2022 onwards.

However, this will likely be delayed to 2023 given the current situation in HK. Meanwhile, UAG’s property assets under management (AUM) rose to JPY32.7bn as at end-4Q2021, up from JPY30.4bn as at end-2020.

UAG will continue to increase property assets under management in Japan to increase the asset management fee derived from this segment.

Valuation & Action: We maintain our OUTPERFORM rating while raising our TP to S$1.66 (prev. S$1.56), based on SOTP valuations.  Joel Ng, analystThe favourable supply-demand dynamics for handysize dry bulk carriers should benefit the group over our forecast period. We maintain our multiple-based valuation for the shipping business at 0.8x FY2022F P/B and 0.6x FY2021F P/B for the Japan & HK property business. Joel Ng, analystThe favourable supply-demand dynamics for handysize dry bulk carriers should benefit the group over our forecast period. We maintain our multiple-based valuation for the shipping business at 0.8x FY2022F P/B and 0.6x FY2021F P/B for the Japan & HK property business.Risks: A supply-demand imbalance in the dry bulk shipping sector that leads to a drop in charter rates will have the largest short-term impact on UAG’s earnings. |

Full report here