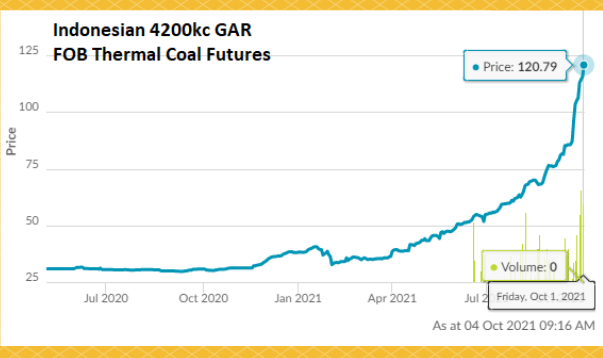

For Singapore-listed Geo Energy and Golden Energy & Resources, the price of 4,200 GAR coal -- the grade of coal they produce -- has been on a relentless upsurge since the start of 2021. That has taken it over the US$100 / tonne level last week. |

Coal futures (Oct, Nov and Dec 2021) have crossed the US$100/ tonne level.

Coal futures (Oct, Nov and Dec 2021) have crossed the US$100/ tonne level.

For more, see SGX website and cme.com.

For perspective:

• Geo Energy's average selling price in 1H2021 was US$40.97 per tonne. In that period, the ICI4 index (a proxy for 4,200 GAR coal) was US$47.78 / tonne. • Geo Energy's average selling price in 1H2021 was US$40.97 per tonne. In that period, the ICI4 index (a proxy for 4,200 GAR coal) was US$47.78 / tonne.• Geo Energy reported net profit of US$48.5 million in 1H2021. |

|

Coal producers |

Stock price |

1HFY21 |

Market cap |

|

Geo Energy |

25 cents |

US$48.5 m |

S$350 m |

|

Golden Energy |

30.5 cents |

US$29.1 m |

S$718 m |

|

* Data as of 24 Sept 2021. |

|||

Geo Energy is a pure coal play while Golden Energy & Resources is not only into thermal coal but also coking coal and gold.

Its coking coal and gold businesses were loss-making in 1H2021 as they were in phases of expansion and not producing optimally.

Back then, coking coal prices were depressed as well.

Add to that, Golden Energy incurred one-off financing costs of US$10.5 million related to a bond transaction.

| • Golden Energy's average selling price for thermal coal in 1H2021 was US$42.56 per tonne. The coal is produced by its 62.5%-owned PT Golden Energy Mines. • Golden Energy reported net profit of US$29.1 million in 1H2021. |

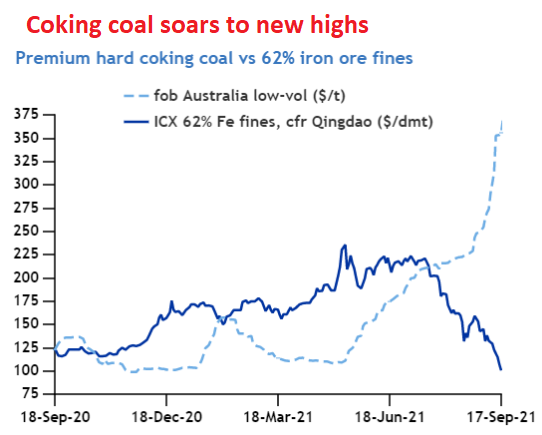

In 2H2021 not only has thermal coal prices risen strongly but also coking coal (for making steel), which will benefit Golden Energy's 60%-subsidiary, Stanmore Resources. (See: Coking coal price hits record highs as Chinese steel-makers face pain )

Coking coal is an essential ingredient for making steel.

Coking coal is an essential ingredient for making steel.

Stanmore's stock which is listed in Australia has, accordingly, gone up about 31% to 91 cents since 1 July 2021.

| The large impact |

The sharply higher prices of thermal coal will also pull up the cash cost of production of Geo Energy and Golden Energy but it will be insignificant relative to the magnified profitability.

How magnified will profits be?

Every 1 million tonnes brings in US$1 million extra revenue for every US$1 rise in selling price.

With selling prices up US$50-60 per tonne over the 1H2021 average, the impact is simply humongous.

Just consider the tonnage that Geo Energy and Golden Energy are targeting to produce:

|

Coal producers |

1HFY21 |

2HFY21 |

2021 production quota* |

|

Geo Energy |

5.3 m |

6.2 m |

11.5 m |

|

Golden Energy |

16.6 m |

23.0 m |

39.6 m |

|

* Quotas approved by Indonesian government |

|||

| Why the surge in thermal coal price |

Thermal coal's upswing has been driven by heavy rains in coal-producing Kalimantan as well as China-Australia geopolitics:

| "A state of emergency has been declared in South Kalimantan's Tanah Bumbu regency until 17 September because of heavy rains and flooding. The rains have also disrupted coal logistics in other parts of Kalimantan. The diversion of cargoes to the domestic Indonesian market after authorities enforced producers' supply obligations is adding to the squeeze. "The support to current market fundamentals also stems from China's ban on Australian coal imports, which has distorted thermal coal trade flows and created unprecedented price imbalances in the market." -- Argus Media article (7 Sept 2021) |

|

Given the above factors supporting the surge in coal price, a reasonable question is of course how sustainable the current prices are.

|

See also:

• GOLDEN ENERGY AND RESOURCES: 64-cent target in KGI initiation report

• GOLDEN ENERGY & RESOURCES: Coal profit surged in 1H2021 but ....