| Geo Energy Resources, and its shareholders, have reason to celebrate: Its strategic shareholder, ResInvest, is bringing forward its agreement to buy Geo Energy treasury shares. Geo's stock price rose by 5% on Dec 24 following the announcement that the Swiss private commodities investor would complete its purchase of the second tranche of Geo Energy’s treasury shares ahead of schedule. The first tranche of sale shares, amounting to US$5 million, was in March 2024. Initially slated for February 2025, the second transaction is now set to close tomorrow (27 Dec):

|

There's no typo.

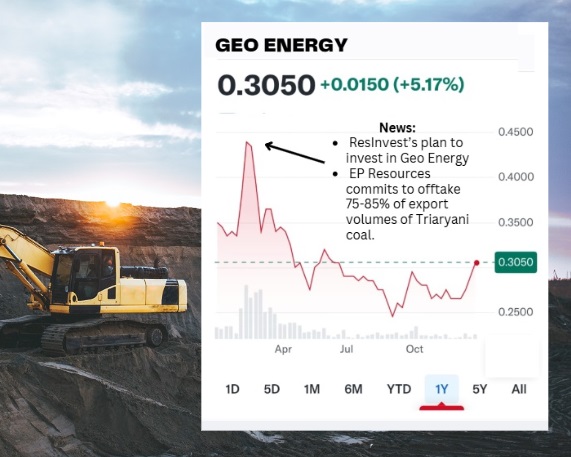

ResInvest's purchase price -- and the warrants exercise price -- are indeed way above the trading level of the stock this year (see chart).  Stock spiked up on investor euphoria over the announcements in Feb 2024 but subsequently trended down on lower y-o-y quarterly results from Geo Energy. Chart: Yahoo!

Stock spiked up on investor euphoria over the announcements in Feb 2024 but subsequently trended down on lower y-o-y quarterly results from Geo Energy. Chart: Yahoo!

And like the first tranche of treasury shares, the second tranche originated from prior share buybacks that Geo Energy did at an average price of 31 cents per share.

The second-tranche purchase will raise ResInvest’s equity stake in Geo Energy to 6.8%, solidifying its position as a substantial shareholder.

It’s not every day that an investor accelerates their commitment to a company.

ResInvest’s decision underscores its confidence in Geo Energy’s business fundamentals and long-term potential.

| This development is part of a broader US$35 million equity investment commitment made by ResInvest in Feb 2024. The following month, ResInvest kicked things off by becoming a substantial shareholder in Geo Energy after acquiring close to 82 million shares through open market purchases and treasury share acquisitions.  Text from Geo Energy's press release in Feb 2024. Text from Geo Energy's press release in Feb 2024. This investment agreement is inter-conditional with another major one : EP Resources AG , part of EPH, one of the largest European energy groups, committed to offtake 75% to 85% of coal from Geo Energy's Triaryani mine. The volume is up to 12 million tonnes of coal per annum for the life of the mine, which is already in production but will ramp up production from 2026. |

Tomas Novotny, Founding Partner of ResInvest, highlighted the company’s progress in export infrastructure and expressed optimism about future collaborations and mutual growth.

“We are pleased to increase our shareholding and deepen our strategic cooperation with Geo Energy. The Geo team is making excellent progress on its export infrastructure, underscoring the company's long-term success and value creation. We look forward to our continued collaboration, future co-investments, and mutual growth.” “We are pleased to increase our shareholding and deepen our strategic cooperation with Geo Energy. The Geo team is making excellent progress on its export infrastructure, underscoring the company's long-term success and value creation. We look forward to our continued collaboration, future co-investments, and mutual growth.”-- Tomas Novotny, Founding Partner, ResInvest |

This vote of confidence from a key investor resonated positively with the market.

Geo Energy’s Charles Antonny Melati, the Executive Chairman and CEO, described the early completion as a testament to the value Geo Energy has created and its vast growth potential.

Beyond the immediate US$5 million inflow for Geo Energy, the issuance of 20,092,500 second-tranche warrants at an exercise price of S$1.00 per share implies additional capital inflow if exercised in the future.

This in turn depends on Geo Energy’s ambitious expansion plans hitting target milestones.

That may propel the stock higher -- it would need to more than triple from current levels before the second-tranche warrants are in the money.

The first tranche of 21,310,227 warrants has am exercise price of 55 cents -- which is some 80% higher than the current stock trading price.

Geo Energy operates multiple mining concessions across Kalimantan and South Sumatra. Its transformative ambition is to develop an Integrated Infrastructure project to enhance its logistics capabilities. This infrastructure is expected to handle up to 40-50 million tonnes of coal per year, supporting both existing operations and future growth initiatives. |