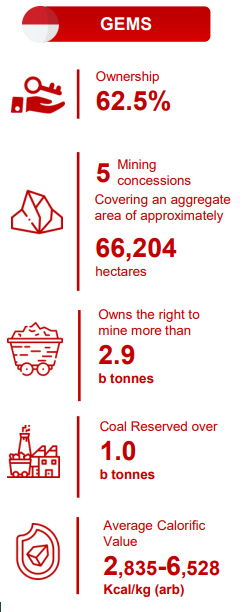

Coal prices were on a tear in 1Q this year and sped up even more in 2Q. It came as no surprise that Golden Energy and Resources (GEAR) posted a whopping jump in profit. GEAR owns 62.5% of GEMS, which is a coal miner in Indonesia.The after-tax profit of the Singapore-listed coal miner surged 129% y-o-y in 1H2021 to US$80.2 millon. GEAR owns 62.5% of GEMS, which is a coal miner in Indonesia.The after-tax profit of the Singapore-listed coal miner surged 129% y-o-y in 1H2021 to US$80.2 millon.But it was puzzling to investors that profit after tax and minority interests was only US$29.1 million. Yes, only .... even though it was 76% higher y-o-y. The main reasons it was not much higher, it turns out, are: • higher royalty paid on thermal coal sales • losses incurred by GEAR's newly-acquired investments in two businesses in Australia • One-off finance costs relating to bond redemption. (Details below) |

"Despite Covid, we have been moving on all fronts -- from our production of coal at GEMS to our inorganic expansion in Australia as well as on the treasury front in terms of financing." "Despite Covid, we have been moving on all fronts -- from our production of coal at GEMS to our inorganic expansion in Australia as well as on the treasury front in terms of financing."-- Mark Zhou, executive director |

GEAR is an investment holding company with a 62.5% stake in Golden Energy Mines (GEMS) listed on the Jakarta Stock Exchange.

In addition, GEAR owns a 60% stake in Australia-listed Stanmore Energy and a 50% stake in a private gold mine operator, Ravenswood.

These two businesses were acquired in 2020, and were loss-making in 1H2021.

| • Stanmore's net loss was A$15.5 million owing to a sharp fall in the selling price of its metallurgical coal. • GEAR's share of loss of Ravenswood was US$6.5 million. While the price of gold was relatively stable, Ravenswood's operations were not optimised as expansion initiatives were still being carried out and will complete only in 1H2022.  |

GEAR's consolidated revenue in 1H2021 was US$806.7 million, or a whopping US$215 million higher than in 1H2020.

Part of that large extra income went to cover the following notable costs:

| • GEAR's cost of sales rose US$96.46 million, or 25.6% higher y-o-y, to US$473.02 million in 1H2021. This was mainly due to an increase in royalty expenses on its Indonesian thermal coal and due to the consolidation of Stanmore’s financial results. • GEAR's administrative expenses increased by US$14.39 million, or 38.0%, to US$52.23 million in 1H2021 mainly due to higher remuneration in line with better performance and due to the consolidation of Stanmore's financial results. • GEAR's finance costs increased by US$14.29 million, or 80.0%, to US$32.15 million in 1H2021 mainly due to one-off expenses aggregating to US$10.52 million. • GEAR'S income tax expenses increased by US$34.12 million, or 200.4%, to US$51.14 million in 1H2021 mainly due to higher profit generated from thermal coal segment and a withholding tax expense on dividends received from GEMS. |

|

Stock price |

28 c |

|

52-week range |

14 – 42 c |

|

Market cap |

S$659 m |

|

PE |

23 |

|

Dividend yield |

-- |

|

1-year return |

67% |

|

Shares outstanding |

2.35 b |

|

Price/Book |

1.07 |

|

Source: Bloomberg |

|

...but 2H2021 profit looks set to be stronger, even though production costs of thermal coal are expected to nudge upward owing to higher fuel costs and possibly higher strip ratios.

Here's why:

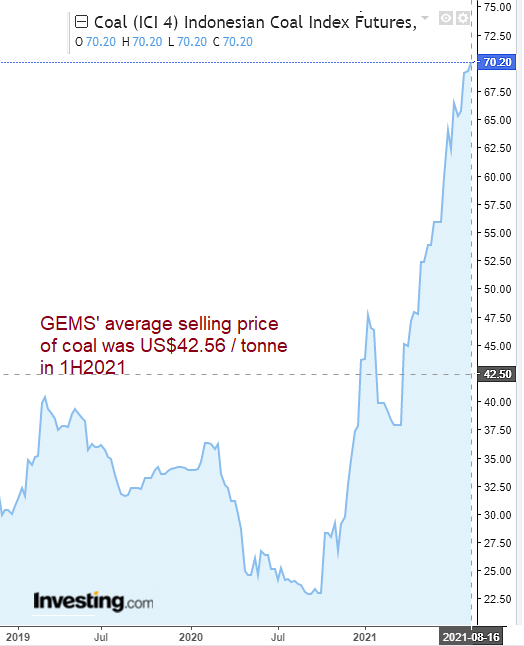

| • Thermal coal price continues to surge in 3Q. For Sept and Oct 2021, ICI4 futures, the best proxy to GEMS' selling prices, have breached the US$70 per tonne level. It's unprecedented. In comparison, GEMS' average selling price in 1H2021 was US$42.56 / tonne. GEM's profit is highly leveraged to coal prices, with every US$1 increase in average selling price for 1 million tonnes bringing in US$1 million extra revenue. For perspective, GEAR's target production this year is nearly 40 million tonnes.  • Higher production volume of thermal coal. GEMS has received government approval to produce 39.6 million tonnes for FY2021, an 18% targeted increase from its production volume of 33.5 million tonnes in FY2020. Given that GEMS produced 16.6 million tonnes in 1H2021, it will be extra busy in 2H2021, targeting to produce 19 million tonnes. • Metallurgical coal prices have rebounded. With a vengeance. While Stanmore's selling price was A$115.2 / tonne in 1H2021, the benchmark index has climbed beyond A$200 / tonne. (See: No peak in sight for met coal prices as supply continues to tighten) • Absence of 1H2021 one-off finance expenses amounting to US$10.52 million. |

Key risks: Fall in coal prices and bad weather impacting coal production in Indonesia.

For more, see GEAR's 1H2021 presentation slides here.

Why announced good results share price gone down? will there any hidden errors that public not aware ?