"Dragon Descendant" contributed this article to NextInsight

| Rubber accelerators, antioxidants, and insoluble sulphur are essential to the manufacture of rubber products. Rubber accelerators shorten the time taken by insoluble sulphur to make rubber harder. Antioxidants make rubber products last longer. As 70% of rubber produced is made into tyres, rubber chemical sales are linked to tyre production. The global one-billion-odd vehicles need new tyres to replace worn-out ones. Tyres are also fitted to new vehicles (around 80m a year). Replacement tyres make up around 70% of total tyre sales. Steady growth of tyre consumption, underpinned by growing vehicle population and stable new vehicle sales, was interrupted in 2020 by Covid-19. |

According to Pirelli, global tyre sales volume in 2020 was down 15% year-on-year. The second half was a vast improvement after the plunge in the first half.

Pirelli, Michelin, and Goodyear went through similar downturns:

|

Year-on-year change in sales volume |

|||||

|

|

1Q20 |

2Q20 |

3Q20 |

4Q20 |

Full year |

|

Global |

-21% |

-35% |

-6% |

-1% |

-15% |

|

Pirelli |

-18% |

-43% |

-4% |

+2% |

-14% |

|

Michelin |

-12% |

-33% |

-7% |

-5% |

-14% |

|

Goodyear |

-18% |

-45% |

-9% |

-5% |

-19% |

Sources: Presentations by Michelin, Goodyear, and Pirelli

However, China Sunsine, which is listed on the Singapore Exchange, fared well. Its sales volume dipped 7% year-on-year in 1H20, when global tyre sales were down 28%.

It grew 10% in 2H when the tyre industry was still not out of the woods.

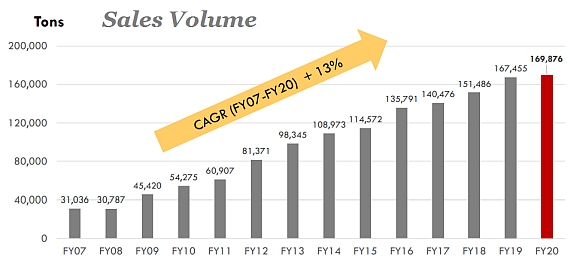

With higher sales in 2H20 (93,556 tonnes vs 1H20's 76,320 tonnes), Sunsine's track record of sales volume growth starting 2008 was unbroken.

In 2020, Sunsine strengthened its leadership in the rubber accelerator industry, garnering 22% market share, from 20% before.

As they are essential items and account for only 3% of tyre production cost, rubber chemicals are sold on a cost-plus basis. Dearer raw materials bode well for Sunsine.

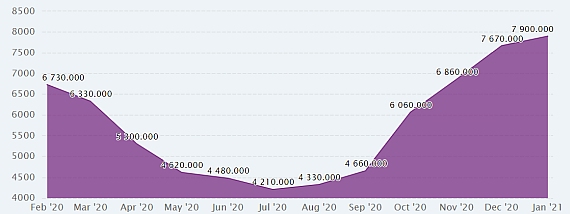

The price of aniline, the main raw material for rubber accelerators and antioxidants, began surging in Oct 20:

Graph A: Monthly average price of aniline (RMB per tonne including VAT). Source: www.ceicdata.com

Graph A: Monthly average price of aniline (RMB per tonne including VAT). Source: www.ceicdata.com

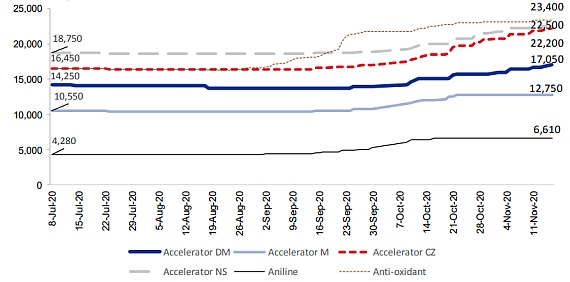

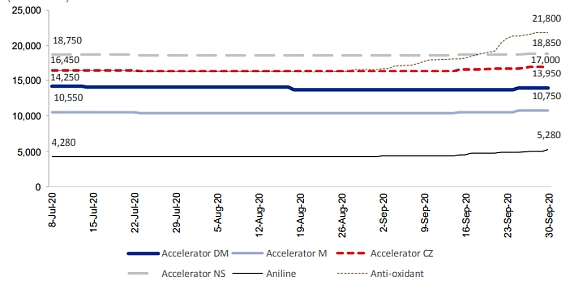

Prices of rubber accelerators rose in tandem.

Graph B shows that rubber accelerator TBBS (known as NS in China) was priced at RMB 23,400 (with VAT) in Nov 20, up from RMB 18,850 in Sep 20 (Graph C).

During the FY20 results briefing, Sunsine's CFO shared that TBBS is being delivered to tyremakers for RMB 24k in 1Q21, up from RMB 19k in 4Q20, as production took place a couple of months after price finalisation.

Graph B: Prices of rubber accelerators and antioxidant 6PPD (from CIMB report dated 17 Nov 2020).

Graph B: Prices of rubber accelerators and antioxidant 6PPD (from CIMB report dated 17 Nov 2020).

Graph C: Prices of rubber accelerators and antioxidant 6PPD (from CIMB report dated 8 Oct 2020) .

Graph C: Prices of rubber accelerators and antioxidant 6PPD (from CIMB report dated 8 Oct 2020) .

Sunsine performed better in 2H20 than 1H20. Gross profit per tonne was RMB 3,827, 21% higher than 1H20's.

Adjusting for RMB 32m forex loss, 2H20 profit was RMB 168m.

|

|

1H20 |

2H20 |

2020 |

|

Revenue (RMB m) |

1,043 |

1,291 |

2,334 |

|

ASP (RMB per tonne) |

13,560 |

13,579 |

13,571 |

|

Sales vol (tonnes) |

76,320 |

93,556 |

169,876 |

|

Gross profit (RMB m) |

242 |

358 |

600 |

|

Gross profit margin |

23.2% |

27.8% |

25.7% |

|

Gross profit per tonne (RMB) |

3,171 |

3,827 |

3,534 |

|

Forex gain/loss (RMB m) |

14 |

(32) |

(18) |

|

Profit (RMB m) |

82 |

136 |

218 |

Outlook for 1H21

Sunsine's 1H21 should be much better than 2H20.

1Q21's ASP should be higher than 2H20's when the higher rubber accelerator prices in 4Q20 are recognised.

Rubber accelerator prices have risen again recently.

Rubber accelerator CBS (known as CZ in China) price has been hovering around RMB 28k after 3 March 2021, a far cry from RMB 22k in Nov 20 and RMB 17k in Sep 20.

Sunsine's 2Q21 ASP should be higher than 1Q21's.

Besides higher ASP, 1H21 may see higher sales of rubber accelerators from the 14% unused capacity:

|

|

Sales volume |

Half yearly capacity |

Utilisation rate |

|

|

(tonnes) |

(tonnes) |

(%) |

|

Rubber Accelerators |

50,470 |

58,500 |

86 |

|

Antioxidants |

24,471 |

22,500 |

109 |

|

Insoluble sulphur |

17,322 |

15,000 |

115 |

In his 26 Feb 21 report, the CIMB analyst said: "We understand that Sunsine’s 20kt rubber accelerator capacity added in mid-2020 has been well absorbed, with growing utilisation rate, and forecast its sales volume will grow 13% in FY21".

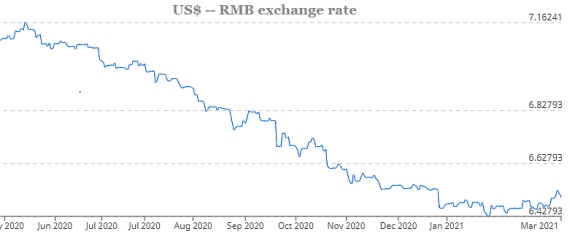

Finally, the US$ has so far been stable after plunging in 2H20. If this stability continues, Sunsine's 1H21 will be spared forex loss, which was experienced in 2H20 and amounted to RMB 32m.

In its results announcement for 2020, Pirelli expressed optimism as follows:

"2021 outlook improving: the global car tyre market expected to grow by 'high single digit' levels.

“Double digit growth seen for Car ≥18’’ market which in 2021 will return to 2019 level."