| Real estate S-chip CWG International is set to be delisted and privatised under an offer headed by its executive chairman and CEO, Qian Jianrong. He is also the controlling shareholder of CWG with a 75.4% deemed interest. Mr Qian is the sole director of the Offeror, a special purpose vehicle called Elidom Investment which is jointly owned by Sinway Investment, H&H Wealth and Floriland. These three parties have given irrevocable undertakings to tender all of their aggregate 81.1% stake in CWG International to accept the offer, which was announced yesterday. |

At the takeover offer price of 19.5 cents a share, CWG (fka Chiwayland International) is valued at about S$129 million.

This is substantially lower than the fair value of 37-57 cents a share that UOB Kay Hian reckoned it was worth in 2016, based on a 63-76% discount to its S$1.55/share RNAV. (See report).

This discount was what China small-cap properties listed in Hong Kong were trading at.

CWG, despite being a S-chip and its poor liquidity, was one of the "top 25 jewel picks of 2017" of RHB Research.

CWG was listed on the SGX in 2014 through a reverse takeover of RH Energy.

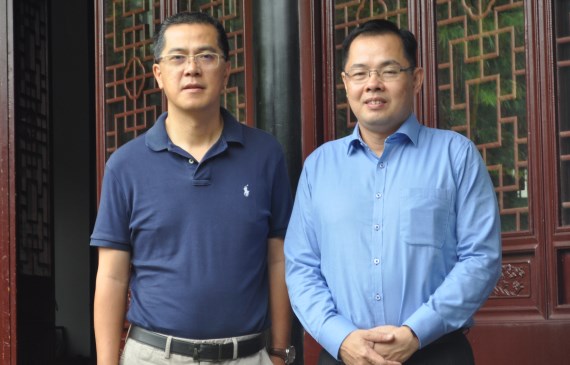

L-R: Qian Jianrong, CEO of CWG, with CFO Chua Hwee Song. L-R: Qian Jianrong, CEO of CWG, with CFO Chua Hwee Song. NextInsight file photo. The CFO of CWG International, Chua Hwee Song, is set to leave for Singapore Press Holdings (SPH), which has announced his appointment as its CFO-Designate with effect from 1 March 2018 and as CFO from 1 April 2018. SPH, a media and property company, has a market cap of about S$4.3 billion. |