Sapphire's new subsidiary, Ranken Infrastructure, is the only private land transportation EPC solutions provider in China with AAA-certification for the design, construction and project consultation of rail infrastructure. Above: Ranken's urban truck road project in Beijing’s urban district, constructed above underground pipelines for sewage, tap water and other facilities. Photo: Company Sapphire's new subsidiary, Ranken Infrastructure, is the only private land transportation EPC solutions provider in China with AAA-certification for the design, construction and project consultation of rail infrastructure. Above: Ranken's urban truck road project in Beijing’s urban district, constructed above underground pipelines for sewage, tap water and other facilities. Photo: Company

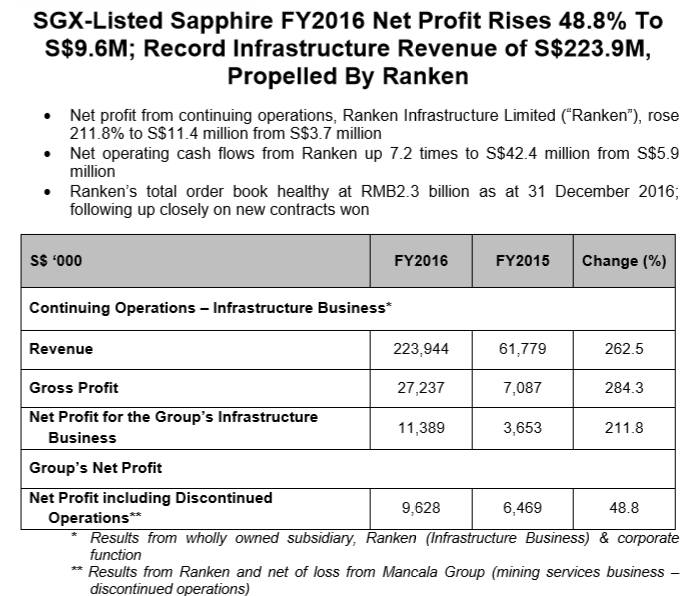

Following Sapphire's divestment of its steel business in 2014, the Group has emerged as a transport infrastructure play. Last October, Sapphire completed the acquisition of Ranken Infrastructure, China’s second-largest privately-owned rail transit infrastructure construction group.

In conjunction with the initiative, Asian Infrastructure Investment Bank expects to approve about US$1.2 billion this year to finance the development of transportation, water and energy infrastructure in less developed Asian countries. Ranken already has a track record for projects in China, Bangladesh, India and Saudi Arabia. For example, it constructed and managed the Alwaye-Petta Line of India's Kochi metro rail project, a major transportation project there. |

| ♦ Mining services business |

|

The other business segment of the Group is Mancala Holdings, an Australian mining services firm that Sapphire wholly acquired in January 2014. |

Below is an excerpt of the questions raised by investment professionals at the meeting and the replies provided by Mr Teh and CFO Kit Ng.  CFO Kit Ng. Photo by Sim KihQ: What amount are you tendering for your projects?

CFO Kit Ng. Photo by Sim KihQ: What amount are you tendering for your projects?

A comfortable value is a rolling order book of Rmb 2 billion to Rmb 3 billion at any single point in time for project execution period of 24 to 36 months.

Our planned expansion in production capacity is a conservative one.

Q: How did you get a foothold in India and Bangladesh?

Doors opened for us in Bangladesh because Ranken’s close associates linked us to the relevant local contacts, people of diverse backgrounds ranging from businessmen to government officials. This allowed us to cross sell our services.

Our first project in Bangladesh was complicated in engineering structure and technical requirement. The management of execution risk was key to its success. This was a project where we focused on contract management and used local contractors for construction work. Having a local track record gave us more opportunity to tender for jobs there.

| Stock price | 24.5 cents |

| 52-week range | 21.3 – 36.9 cents |

| PE (ttm) | 9.98 |

| Market cap | S$83.1 million |

| Shares outstanding | 326.0 million |

| Dividend yield (ttm) |

- |

| Cash reserves | S$25.9 million |

| Source: Bloomberg |

Q: How was the yield for your Bangladeshi project compared to your projects in China?

We structured the Bangladesh project such that our fee stream was pegged to project contract value as management fees while local contractors were responsible for civil engineering and worker deployment.

Q: Who will fund the PPP projects that you intend to go into?

This depends on whether the project can be wholly or partly privatised. A consortium may be formed by strategic partners, sophisticated investors or a syndicate. This is an important alternative financing mode for larger scale infrastructure projects, moving forward.