Uni-Asia's CFO, Lim Kai Ching, presenting the company's 1Q16 results. Photo by Reyna Mei

Uni-Asia's CFO, Lim Kai Ching, presenting the company's 1Q16 results. Photo by Reyna Mei

ABOUT 70% of Uni-Asia Holdings' assets are ships, which means that a recovery in the shipping industry is crucial to the company's fortunes, noted an investor.

What is the outlook for the industry, he asked at last week's 1Q16 results briefing. Michio Tanamoto, executive chairman of Uni-Asia Holdings. NextInsight file photo.To begin with, Uni-Asia (through 100%-owned subsidiaries) owns one containership and 10 bulk carriers. It also has a stake in 8 other vessels held under joint investment companies.

Michio Tanamoto, executive chairman of Uni-Asia Holdings. NextInsight file photo.To begin with, Uni-Asia (through 100%-owned subsidiaries) owns one containership and 10 bulk carriers. It also has a stake in 8 other vessels held under joint investment companies.

To the investor's question, Uni-Asia Holdings' executive chairman Michio Tanamoto explained it as a matter of supply and demand, citing industry figures to back him up.

1. In 2015, the tonnage of seaborne trade using dry bulk carriers suffered negative growth for the first time since the Lehman crisis in 2008.

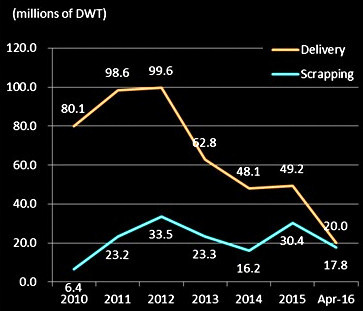

But the world's dry bulk fleet, in tonnage terms, expanded by 2.4% that year. (No prizes for guessing how that affected charter rates). 2. When it comes to the scrapping of dry bulk capacity in 2015, it lagged behind the supply of new capacity.

2. When it comes to the scrapping of dry bulk capacity in 2015, it lagged behind the supply of new capacity.

That gap, which has been closing in recent years, finally almost disappeared in the first four months of this year.

In other words, delivered new capacity and scrapped old capacity more or less cancelled each other (see chart on the right).

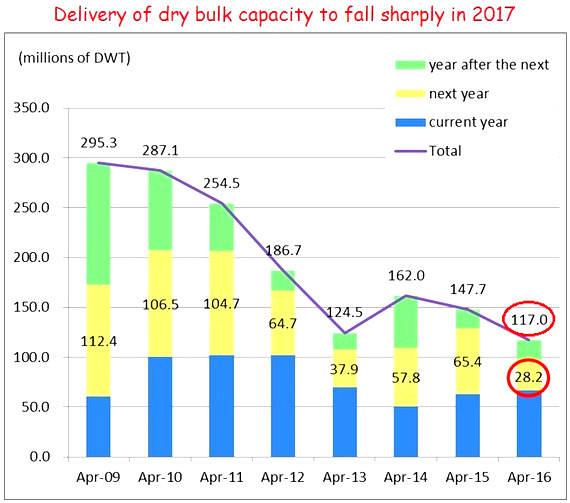

3. In the next two years, new added capacity will shrink further (see chart below).

As at April this year, the orderbook for dry bulk vessels to be delivered next year stood at about 28.2 million DWT, more than 50% lower than just a year ago.

As as result, charter rates could rise by double-digit percentages over the next few years, said Mr Tanamoto.

"Demand and supply is going to be adjusted substantially next year, which will help the market to recover. We expect 2018 and 2019 will be even better years," said Mr Tanamoto.

"But this year, we will continue to face difficult times."

The difficulties are felt particularly by Uni-Asia's older vessels.

Of the nine bulk carriers that Uni-Asia owns (they are wholly-owned or majority-owned) under its Uni-Asia Shipping subsidiary, five currently have multi-year charters with competitive rates.

| Stock price | $1.18 |

| 52-week range | $1.00 – $1.45 |

| PE (ttm) | 23 |

| Market cap | S$55 million |

| Shares outstanding | 46.98 million |

| Dividend yield (ttm) |

5.3% |

| Net asset value/share | US$2.99 |

| Source: Bloomberg |

However, the remaining four are older vessels whose long-term charters expired one or two years ago. At that time, charter rates were depressed and Uni-Asia chose to charter them out for short durations of a couple of months only -- while waiting for rates to recover.

While the shipping segment stays challenging, Uni-Asia continues to be supported by its property and hotel segments.

Overall, the group lost US$616,000 in 1Q2016, compared to a profit of US$285,000 in 1Q2015.

The loss was mainly due to fair value loss on its ships and derivative financial instruments used for hedging.

For details of the 1Q2016 results, see the Powerpoint materials here.