FY15 is the third successive year that Uni-Asia Holdings has proposed a final dividend of 6.25 Singapore cents a share (post share consolidation).

Photo by Leong Chan TeikThis translates into a yield of 5.4% based on recent share price of S$1.15.

Not only is the yield decent, the stock trades at a hefty discount to its US$2.98 book value.

The company reported US$2.7 million net profit attributable to shareholders, up 25% year-on-year while total income (or revenue) grew 15% to US$77.1 million.

| Net profit (US$'000) in 2015 | % change | |

| Non-consolidated Uni-Asia (Investment & Asset Management of Vessels & Properties in China/HK) |

(757) |

(60%) |

| Uni-Asia Shipping Ltd Ship Owning & Chartering |

613 | (72%) |

|

Uni-Asia Capital (Japan) Ltd |

3,004 |

68% |

| Uni-Asia Hotels Ltd Hotel Operation in Japan |

717 | 954% |

| Group total (before minority interest) | 3,520 |

67% |

Operating profit rose 59% to US$8.9 million.

Uni-Asia has two main business segments -- property and shipping.

Its property projects in Japan and Hong Kong (and hotel operations in Japan) have done relatively well but shipping is a different story in some respects.

Uni-Asia had to recognise fair value losses (US$3.2 million) on its ship investments and an impairment (US$1.4 million) on an old ship in 2015.

The bright side is that charter income has continued to rise (by 57.6% y-o-y to US$30.5 million) with the addition of two dry bulk carriers, bringing the total fleet size to eight. A containership was also bought last year.

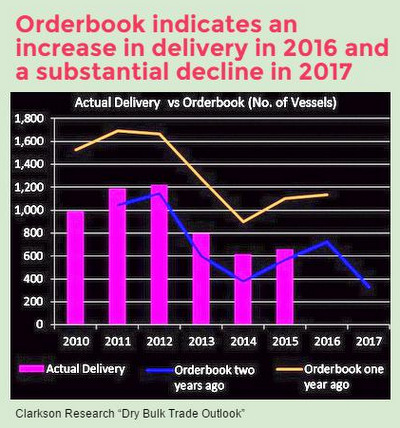

| At the FY15 results briefing, Uni-Asia executive chairman Michio Tanamoto was asked if the company should even stay on in the dry-bulk business given the oversupply and the structural changes in the industry. Reflecting that, the Dry Bulk Index (335 points) recently hit a 28-year low.  Mr Tanamoto dived into statistics that basically showed that supply and demand in, particularly, the handysize bulk carrier market will likely turn favourable next year. Mr Tanamoto dived into statistics that basically showed that supply and demand in, particularly, the handysize bulk carrier market will likely turn favourable next year.The projected delivery of new bulk carriers will dive in 2017. In the meantime, the scrapping of bulk carriers is expected to grow 3-4% a year. "In 2017, we might see a decline in the bulk carrier fleet for the first time since 1990, the first time in more than 20 years," said Mr Tanamoto.  Michio TanamotoHe also pointed out that the supply-demand balance is most favourable for handysize dry bulkers, which are the smallest bulkers and the category that Uni-Asia focuses on: Michio TanamotoHe also pointed out that the supply-demand balance is most favourable for handysize dry bulkers, which are the smallest bulkers and the category that Uni-Asia focuses on: ♦ Aging: The handysize category has the highest percentage of fleetsize which is above 15 years of age. ♦ Renewal: The handysize category has the lowest percentage of orderbook for new vessels versus the number of vessels of 15+ years. |

Meanwhile, Uni-Asia's hotel operation business, which reported a US$717,000 profit in 2015, looks set to do well this year.

The 10th hotel in Japan to come under its management is Hotel Vista Sendai, which will open in April this year.

Its location could not be better -- it's next to a new subway station (Miyagino-dori station) which opened in Dec 2015.

For the PowerPoint slides used in the results briefing, click here.