“Containership operators of 8000 TEU and above benefit from the economies of scale in transporting a larger number of containers with the same crew size. The new ships burn less fuel, and bunker is now cheaper.”

“Containership operators of 8000 TEU and above benefit from the economies of scale in transporting a larger number of containers with the same crew size. The new ships burn less fuel, and bunker is now cheaper.”

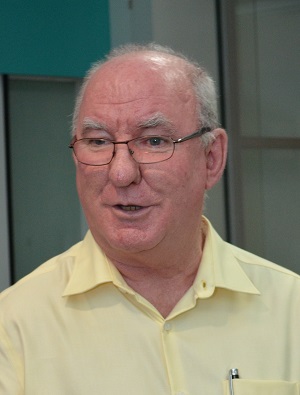

- Executive Chairman Mike Sim, on why demand from shippers remain firm.

Photo by Sim KihMost companies in the oil & gas sector have been hit by the precipitous fall in crude oil prices in the past 2 years, but Sinwa Limited has posted a surprisingly strong set of results over the same period.

During the 2-year period over which the oil price fell from US$100 to less than US$40 a barrel, Sinwa’s net profit surged by a CAGR of 19%.

The market leader for marine, offshore and logistics supplies in the Asia Pacific region posted a 7.9% year-on-year increase in FY2015 revenue to S$166.5 million. Net profit attributable to shareholders increased by 14.2% to S$9.6 million.

It is also paying handsome dividends: a 0.75-cent regular dividend plus a 1.0-cent special dividend for 2HFY2015 on top of a 2.25-cent special interim dividend paid last September.

The total annual dividend of 4 cents per share brings its dividend yield to a whopping 18.6%, based on a recent stock price of 21.5 cents.

| Sinwa | 21.5 ct |

| 52-week Range | 19.1 - 24 ct |

| Market Cap | S$73.3 m |

| Trailing PE | 10.3x |

| Dividend yield | 18.6% |

| Gearing | 0.03x |

| Bloomberg data | |

At a briefing on Tuesday, Executive Chairman Mike Sim said Sinwa had been shielded from the project delays and cancelations that affected oil & gas players. Only about one third of Group revenue is exposed to the oil & gas sector. Most of the Group’s revenue is driven by shipping demand.

Geographically, in FY2015, 79% of its revenue was from Singapore. Australia, where the depreciation of the Aussie dollar has encouraged spending on vessel supplies, contributed 16%. The remaining 5% came from Thailand and China.

For details of its FY2015 results, click here.

Below is a summary of questions raised and the answers provided by Mr Sim, Group CEO Bruce Rann and Financial Controller Elvin Law.

We are in litigation with the former JV partner owner of this vessel. After such a long time, the case will open for hearing in March or April this year.

|