| IN RECENT TIMES, a number of SGX-listed companies have attracted substantial investments from PRC investors, which is part of a global trend of Chinese investors snapping up assets. For example:  » Luye Medicals Group acquired a 28.15% stake in AsiaMedic in 2015, which has been diluted to 24.44% last week following a private placement of new shares by AsiaMedic. (See: ASIAMEDIC: IPC's Ngiam brothers to take 10.24% stake) » Luye Medicals Group acquired a 28.15% stake in AsiaMedic in 2015, which has been diluted to 24.44% last week following a private placement of new shares by AsiaMedic. (See: ASIAMEDIC: IPC's Ngiam brothers to take 10.24% stake)» Great Group (now known as Forise International) attracted Forise Capital Group, which now owns 53.08% of the company. Forise owner Wang Xin had bought rights shares that Wen Weiwei, the previous CEO, undertook to sell to him last year. (See: FORISE INTERNATIONAL, EDITION LIMITED: Two pennies to keep watch of?)  » AsiaTravel.com is awaiting the inejction of S$100 m cash by ZhongHong Holding (See: ASIATRAVEL.COM: No takeover but China investor to pour in S$100 m). » AsiaTravel.com is awaiting the inejction of S$100 m cash by ZhongHong Holding (See: ASIATRAVEL.COM: No takeover but China investor to pour in S$100 m).» Then there's CEFC International, which became a S$1-billion company just about six months ago after its stock price leapt over 1,000%. The trader of petrochemical and petroleum products has arisen from the ashes of the fomer Sun East Group. |

| ♦ Sapphire Corp gets new PRC substantial shareholder |

|

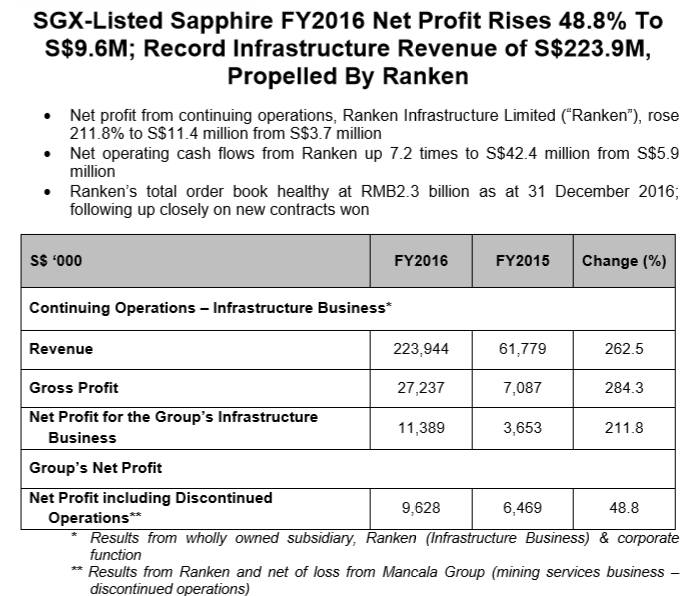

Now, Sapphire Corporation has announced the emergence of a new PRC substantial shareholder -- Ou Rui Group Limited, a company incorporated in Hong Kong and wholly owned by one of the richest PRC nationals, Mr Li Xiaobo. |