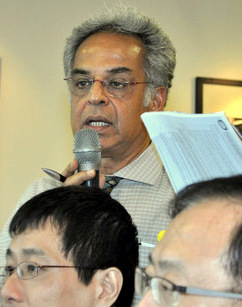

Richard Elman, 75.

Richard Elman, 75. Photo: CompanyLadies and gentlemen, I sincerely welcome you all to our shareholders’ meeting today.

It has been a difficult few weeks for all of us, including you our genuine shareholders, but we will put in all our effort to make sure that wrongs will be made right.

I want to make a few comments: Nothing that Noble has done has been shown to violate any accounting rules. Not a single independent analyst has called into question the honesty or legality of the accounts. Some have said they may be aggressive; some have said they are normal to the industry. People can and do take a view on these things. The point I want to make is, not a single qualified independent analyst has said that Noble has violated accounting or reporting standards.

We have recently found several hedge funds were canvassed proposing a profit focused shortselling venture target on Noble over the last year. It was only after the hedge funds reviewed the reports and found them not experienced or dependable enough, and rejected the business proposal, that were then morphed into a “public spirited whistle blower”. The “public spirited whistle blower status” was a direct result of his failure to be taken seriously as a for-profit short seller by sophisticated hedge funds. He apparently become public spirited only after being not taken seriously by the several professional short-sellers he spoke to.

As you can guess, I am talking about Iceberg.

I want to tell you sincerely that we are here to defend our people, our genuine shareholders from misinformation and attack.

The Iceberg issue is finished. We have started legal proceedings and we look forward to challenging their inaccurate, unreliable and misleading claims in a public court. We have a solid, highly liquid balance sheet and the backing of our stakeholders - Institutions, retail investors, banks, regulators and analysts. Our focus is firmly on running the business - to achieve our goal of becoming the leading mover of physical commodities in the world.

As the Chairman, with a significant shareholding in the Company myself, I feel aggrieved about what has happened over the past two months as you must do. We believe that all of the recent scaremongering has been carried out to deliberately drive our share price lower, to profit from short-selling. In a moment you’ll hear from our CEO, Yusuf Alireza, about the robust condition of your Company.

But first I’d like to reiterate, for the record, that we categorically reject all allegations made in the recent reports as inaccurate, unreliable and misleading. You cannot get a stronger statement from a publicly listed company.

So, to repeat once again: We consider the Iceberg matter finished. We have started legal proceedings and we look forward to challenging their inaccurate, unreliable and misleading claims in a public court. We don’t think there is a better venue to challenge these allegations than in front of a judge in a court which is open to the public.

The recent Muddy Waters report barely dignifies a response. It was short, it re-hashed an old allegation, it contained no new evidence and it used a very absurd behavioural analysis of one analyst phone call. The market was clear in its response to this short-selling report – our shares lost only 2% to the end of the week. But with their stated short position it is in their best interests to continue making false allegations against the Company. In the interests of protecting our shareholders from these reports, we have provided to these allegations with swift rebuttals posted to SGX. We will not, we will not be revisiting details of these allegations in this meeting.

Our Company, your company, is in a robust condition. Over the last 20 years we have grown from a revenue of $377m to $85bn. We have a solid, highly liquid balance sheet: $5.2 billion of liquidity headroom; Debt to capitalisation is at a historic low of 38%; $904m of cash at the year-end; our dividend payment to shareholders is now 35%, up from previous 25%. We have the backing of our stakeholders - institutions, retail investors, banks, regulators and analysts. Our banks are organising normal revolving credit facilities of $2.25bn. Of 16 analysts who cover us ten have buy calls, with six having hold calls. There is not a single sell call.

So, our focus now is firmly on running the business and we will not be sidetracked by people who are trying to deviate us from doing that. We need to achieve our goal of becoming the leading mover of physical commodities in the world.

I will now like to hand over to our CEO, Mr Alireza, who will give you a powerpoint presentation and an update of the Company’s activities. Thank you very much for listening to me. [Applause]

|

|

Caveat emptor : Adolf Hitler once said "The greater the lie, the more readily it will be believed".