Excerpts from analyst's report

|

§ On the cusp of multi-year growth, having completed long-term transformation. |

Investment case: Cusp of new growth phase

Venture is an electronic manufacturing service provider rich in intellectual property and domain knowledge. This allows it to participate in its customers’ supply chains as a highlydifferentiated manufacturing partner.

It is entering a new growth cycle, which could be characterised by growing involvement in life sciences, medical devices and 3D printing. Earnings recovery was kick-started last year, after it completed its transformation from a consumer products to enterprise solutions provider.

Catalysts: Life Sciences & Optical Communications

It is entering a new growth cycle, which could be characterised by growing involvement in life sciences, medical devices and 3D printing. Earnings recovery was kick-started last year, after it completed its transformation from a consumer products to enterprise solutions provider.

Catalysts: Life Sciences & Optical Communications

The company sees growth opportunities this year in: 1) life sciences, where its major customers have announced strong prospects; and 2) optical communications, where US-based customers are expected to benefit from telcos’ expansion and investments in wireless networks and technologies.

Valuation: SGD10.25 TP

Valuation: SGD10.25 TP

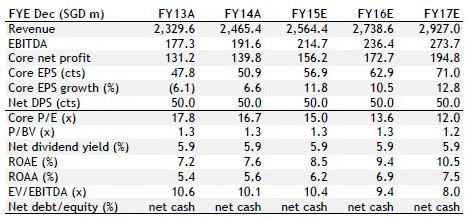

Our TP is based on 18x FY15E EPS, slightly below the sector average of 20x, which include industry peers Benchmark Electronics and major customers such as Agilent and Oclaro. Dividend yields are also attractive at ~6%.

Risks: Manageable

Risks: Manageable

M&As and restructuring among its customers could affect its growth. These include the Agilent/Keysight restructuring, and Intermec/Honeywell & Micros/Oracle mergers. Good execution is key. Several customers have also expressed concern about political/currency deterioration in Europe but Venture’s exposure to Eurozone is minimal.