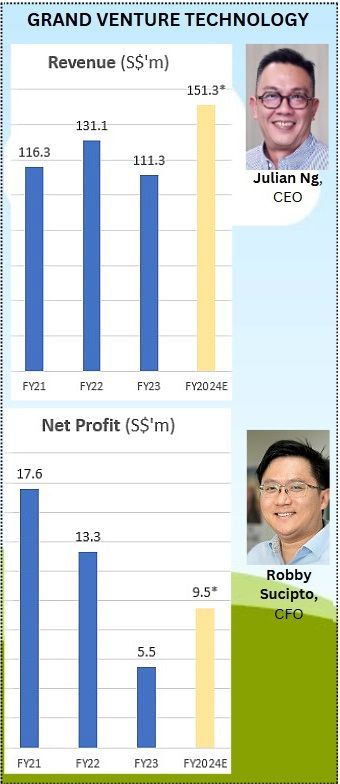

• Grand Venture Technology (GVT) is Singapore-listed but has a rich connection with Malaysia as it has factories across the Causeway. In Sept 2024, it said it was pursuing a secondary listing on Bursa Malaysia.  *Assumes 2H24 revenue is $83 m, which is midpoint of GVT guidance. *Assumes 2H24 revenue is $83 m, which is midpoint of GVT guidance.Assumes 2H24 net margin = 1H24 net margin Asked about this at the recent 3Q2024 results briefing, CFO Robby Sucipto cited potentially richer valuation, higher liquidity, and access to more funds and investors in Malaysia. But he couldn't go into details as the initiative is ongoing and confidential. • GVT has popped up in a 29 Nov 2024 DBS Research report which named it along with Venture Corp as potential beneficiaries from the tech sector of the upcoming Johor-Singapore Special Economic Zone: "Given that manufacturing wages in Malaysia are more than 5x lower compared to Singapore, we are of the view that Singapore companies could potentially shift lower value-added manufacturing to Johor, providing opportunities for margin expansion." • Malaysia and Singapore leaders are scheduled to meet in December 2024 for their 11th Retreat, with the Special Economic Zone a key topic. Meanwhile, read more about GVT in excerpts of a DBS report below, which raised the target price significantly from 58 cents to 70 cents .... |

Excerpts from DBS Group Research report

Analysts: Amanda Tan & Lee Keng Ling

Grand Venture Technology

Delayed but not derailed

| • Double digit growth in revenue (+35.8% y/y) and adjusted net profit (+59.0% y/y) in 9M24 mainly driven by strong semiconductor performance, in line • Better 2H24 on the cards with growing confidence of recovery in 2025 • GVT well positioned to capitalise on AI in both the semiconductor front-end and back-end with its suite of offerings |

Grand Venture Technology Limited (GVT) was established in 2012 and it is a manufacturing solutions and services provider for the semiconductor, life sciences, electronics, medical, and industrial automation industries. Its manufacturing plants are located in Singapore, Malaysia, and China with a total of 540k sqft of factory floor area. |

Investment Overview

High-growth company with a strong blue-chip customer base. Over the past five years, GVT has delivered strong revenue and earnings growth with CAGRs of 29% and 16%, respectively.

GVT also serves a blue-chip customer base – in the semiconductor back-end space, it serves four of the top six; in the analytical life sciences segment, it serves three of the top 10.

The products that GVT supplies are made to certain product specifications, and thus its customer base tends to be sticky in nature.

Significant contributions from the front-end semiconductor space remain a crucial catalyst.

Within the semiconductor segment, GVT’s exposure to the back end is about 90-95%, implying 5-10% exposure to the front end.

Contributions in FY24 from new front-end customers will remain small, while FY25 contributions are expected to be more significant.

A promising grand venture nonetheless, as long-term semiconductor uptrend remains intact.

Notwithstanding near-term volatility, the semiconductor industry is well poised for growth, owing to the push towards digitalisation.

| GVT | |

| Share price: $0.55 | Target: $0.70 |

McKinsey projects that the semiconductor industry will become a trillion dollar industry by 2030.

Long-term semiconductor outlook looks bright, which should benefit GVT, as more than half of its revenue comes from the semiconductor segment.

The other segments GVT has diversified into should remain resilient, which should help cushion semiconductor weaknesses in the near term.

|

Maintain BUY with higher TP SGD0.70 (vs SGD 0.58 previously). We believe that FY24 is a turning point for the group with momentum to continue through FY25 as the semiconductor equipment market recovers and new front-end contributions come in more meaningfully. |