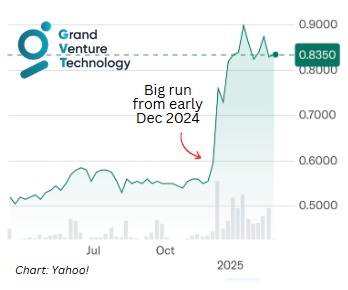

| Grand Venture Technology (GVT) may turn out to be the next delisting story. It said it is in confidential talks with a third party about a possible deal that could include an offer for GVT shares.  It is up 46% in the past one year for a market cap of S$285 million. It is up 46% in the past one year for a market cap of S$285 million.

These discussions are still at an early stage, and there’s no guarantee they will lead to anything, it added. |

GVT is not a neglected and grossly undervalued stock like some recent targets of privatisation.

Neither does it suffer from low trading volumes.

Instead, it looks to be alluring to a potential bidder for its exposure to the booming artificial intelligence (AI) and high-performance computing (HPC) industries.

It manufactures precision components for advanced semiconductor processes like thermal compression bonding and hybrid bonding—critical technologies for AI chips and HPC systems.

Its stock certainly has done well in the past year (see chart above).

What is DBS Research's target price for GVT?

The analysts consider GVT a "high-growth company with a strong blue-chip customer base".

| GVT | |

| Share price: 84 c | Target: $1.12 |

Its February 2025 report set its target price-earnings ratio at 21x FY26F (close to historical mean).

The generous valuation resulted in a target of $1.12 for the stock, or a nice 33% jump from the current level.

"Notwithstanding cyclicality, the semiconductor industry is poised for growth, owing to the push towards digitalisation," said DBS.

See also: GRAND VENTURE TECHNOLOGY: After strong 2024, this company issues upbeat guidance for 1H2025.