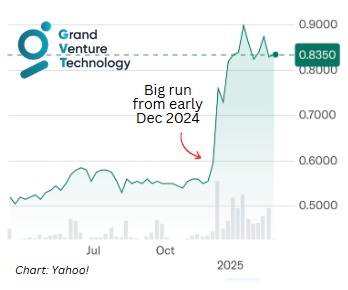

• Grand Venture Technology (GVT) is part of the story of the booming artificial intelligence (AI) and high-performance computing (HPC) industries. It manufactures precision components for advanced semiconductor processes like thermal compression bonding and hybrid bonding—critical technologies for AI chips and HPC systems.  • Its stock has done well in the past year. • Its stock has done well in the past year. It is up 76%, from 46.5 cents to 83.5 cents (see chart). This has pushed its market cap to S$283 million. • Over half of its 2024 revenue came from the semiconductor sector.  • As industries increasingly adopt AI and HPC to fuel innovation, GVT’s role as a supplier of high-precision, complexity-driven solutions positions it to benefit from this unstoppable trend. • As industries increasingly adopt AI and HPC to fuel innovation, GVT’s role as a supplier of high-precision, complexity-driven solutions positions it to benefit from this unstoppable trend.• The exciting growth in GVT's business is coming from the front-end of the semiconductor industry -- ie, where the focus is on the fabrication of semiconductor wafers and the creation of integrated circuits on these wafers.  "We have invested ahead of the curve into new facilities and capabilities to capture new customers and wallet share; further margin upside expected with higher future utilization and operating leverage."The dollar value of the front-end equipment industry is 10X that of the back-end. "We have invested ahead of the curve into new facilities and capabilities to capture new customers and wallet share; further margin upside expected with higher future utilization and operating leverage."The dollar value of the front-end equipment industry is 10X that of the back-end.• Novo Tellus is a shareholder in GVT, with a significant stake of 26.7%, which was purchased about four years ago (See: GRAND VENTURE TECHNOLOGY: Novo Tellus to buy S$30 million controlling stake).As a private equity investor, Novo Tellus is well known for its role in transforming AEM Holdings several years ago. Looks like it identified another gem. Read more about GVT in a DBS report below .... |

Excerpts from DBS Group Research report

Analysts: Amanda TAN & Lee Keng LING

Grand Venture Technology

|

Grand Venture Technology was established in 2012 and it is a manufacturing solutions and services provider for the semiconductor, life sciences, electronics, medical, and industrial automation industries. Its manufacturing plants are located in Singapore, Malaysia, and China with a total of 540k sqft of factory floor area. |

Investment Thesis:

High-growth company with a strong blue-chip customer base.

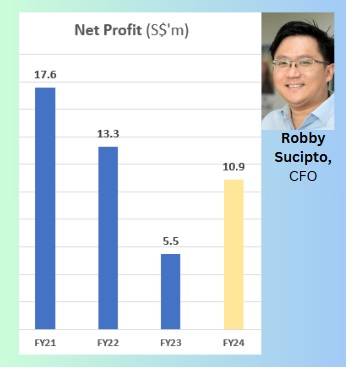

GVT has delivered strong revenue and earnings growth with 4-year CAGRs of 27% and 20%, respectively.

GVT serves a blue-chip customer base – in the semiconductor back-end space, it serves four of the top six; in the analytical life sciences segment, it serves three of the top 10.

The products supplied by GVT are manufactured to specific specifications, and the stringent process required to secure customers creates a strong competitive moat for the company.

| GVT | |

| Share price: 84 c | Target: $1.12 |

Significant contributions from the front-end semiconductor space remain a crucial catalyst.

GVT is involved in front end processes such as etch, deposition, inspection, and metrology across technologies the likes of through-silicon via, atomic layer disposition, and high precision metrology.

FY25 contributions from new front-end will grow meaningfully from a small base in FY24, followed by more significant contributions in FY26.

Still a promising grand venture, as long-term semiconductor uptrend remains intact.

Notwithstanding cyclicality, the semiconductor industry is poised for growth, owing to the push towards digitalisation.

McKinsey projects that the semiconductor industry will become a trillion-dollar market by 2030.

The long-term semiconductor outlook looks bright, which should benefit GVT, as more than half of its revenue comes from the semiconductor segment.

|