Page 1 of 2

Time & date: 10 am, 27 March 2015

Time & date: 10 am, 27 March 2015Venue: Grand Mercure Roxy Hotel

SHAREHOLDERS were keen to ask questions and the CEO and his management team fielded them for about an hour, until no one else stood up with further questions.

Teo Hong Lim, Chairman & CEO of Roxy-Pacific Holdings. NextInsight file photo.Key takeaways from the Q&A session:

Teo Hong Lim, Chairman & CEO of Roxy-Pacific Holdings. NextInsight file photo.Key takeaways from the Q&A session:» Why has the dividend payout not increased? What is Roxy's business strategy in a challenging Singapore market?

On why the dividend has been maintained at 1.913 cents a share, unchanged from FY2013, Chairman & CEO Teo Hong Lim said the payout is very much based on Roxy-Pacific's recurring income -- which comes from the hotel business.

While the group's profits have risen over the years, the fact is much of the profit came from property development projects in Singapore, and the market is cyclical.

"It could be a good strategy to retain capital to capture opportunities in the market," said Mr Teo.

He cited a time post-Lehman crisis, when Roxy-Pacific didn't have any landbank but when the property market started recovering, Roxy quickly made acquisitions of landbank, including the en-bloc purchase of Spottiswoode which reaped a high profit margin for the group.

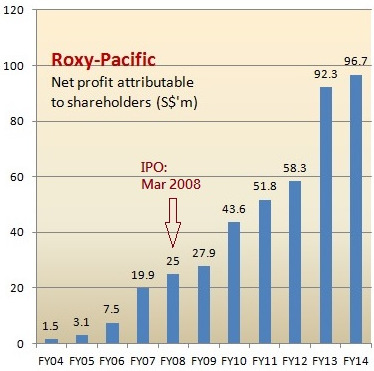

2014 was Roxy-Pacific's 10th successive year of record profit."The aim is to grow the mid- and long-term value, increasing the asset value per share. By growing the assets and the profits, shareholders can benefit from higher dividends and share value," he said.

2014 was Roxy-Pacific's 10th successive year of record profit."The aim is to grow the mid- and long-term value, increasing the asset value per share. By growing the assets and the profits, shareholders can benefit from higher dividends and share value," he said.Despite the Singapore market being in the doldrums, Roxy-Pacific will seek out opportunities there and not forsake it. In the meantime, it has also been going overseas.

"Singapore is our key focus where we will do more than 50% of our business. Overseas, at the moment we have decided to focus on Australia and Kuala Lumpur."

In Australia, Roxy has struck up partnerships with well-known names Aviva and Hostplus, and made its fourth investment to date -- a large tract of industrial land which could be re-zoned as residential within two years.

» What's the impact of the government's cooling measures on Roxy?

Mr Teo said Roxy had been intensively trying to sell its remaining property projects. The projects are 2-3 years away from their respective deadline after which an extension fee is payable to the government.

(Developers have up to five years to finish building a project and two more years to sell all the units. To extend the sales period, developers pay 8 per cent of the land purchase price for the first year of extension, 16 per cent for the second year and 24 per cent from the third year onwards. The amount is pro-rated based on the proportion of unsold units.)

Mr Teo cited Trilive, for which Roxy has changed its reward structure for agents. The project sold only 20 units last year but has sold up to 60 units now.

Form a subsidiary to buy leftover units? It would be a painful move, as it would incur 18% stamp duty, replied Mr Teo.

this site. It's simple, yet effective. A

lot of times it's challenging to get that "perfect balance"

between usability and visual appearance. I

must say that you've done a fantastic job with this.

Additionally, the blog loads super quick for me on Safari.

Outstanding Blog!

Also visit my web page - New Condo @ Kovan (Cassie: http://www.trilive-showflat.com/)