Page 2 of 2

|

Direct-selling licence in China

Chief Operating Officer Huang Ban Chin. NextInsight file photo.Going forward, a big catalyst for Best World would be the award of a direct selling licence in China. Chief Operating Officer Huang Ban Chin. NextInsight file photo.Going forward, a big catalyst for Best World would be the award of a direct selling licence in China.

It has announced, briefly, that its licence application “is proceeding on schedule”.

China’s huge potential for direct selling is reflected in the fact that Amway has reported that it earned more than US$4.8 billion in revenue in 2013 from China. The country is Amway's biggest market, in fact.

Direct selling is a key distribution channel in China. Direct selling represented 64% of total vitamins and supplements sold in China in 2012.

Best World operates direct selling in both Taiwan and Hong Kong, though the revenue figure for Hong Kong is included as total revenue of China.

By comparing the revenue from China and export figures (including exports to Myanmar), we can estimate that revenue for Hong Kong should be more $5m in 2014, from probably a small start in 2013.

The seemingly strong growth from Taiwan and Hong Kong hints at how Best World's growth may pan out once it obtains a direct selling license in China, where many large cities have populations that are growing richer.

I hope to hear more about this from the management during the AGM.

|

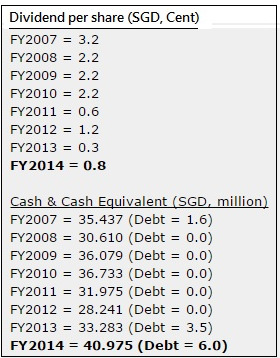

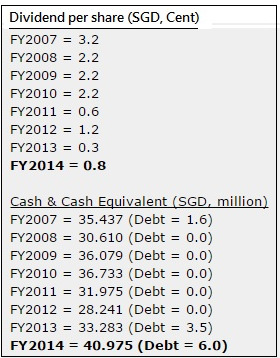

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.

Ex-net cash, the business sells for only S$21 million or a P/E of 5 times.

The Board has recommended a final dividend of 0.5 cent per share, taking the total dividend for FY2014 to 0.8 cent per share.

This represents a dividend payout of 43.5% of the Group’s FY2014 net profit.

Given such highly attractive financials, it is not surprising that insider buying was strong last year at the 19-20 cent level. The current share price is 25.5 cents.

And in the 2013 annual report, tycoon Sam Goi was listed among the top 20 shareholders. Chances are his name will appear again in the list in the upcoming 2014 annual report.

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.

Compiled by Boon @ Valuebuddies.comBest World's S$35 million in net cash constitutes 63% of its market cap of S$56 million.