A reader contributed this article

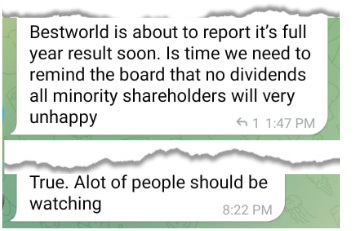

The upcoming financial results announcement of Best World International will be keenly watched because of one key factor. Will there be a dividend or not? The upcoming financial results announcement of Best World International will be keenly watched because of one key factor. Will there be a dividend or not?That's the single top topic in a Telegram group that has some 300 members. |

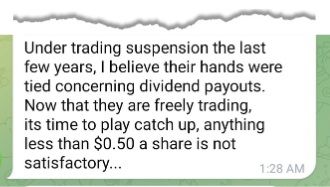

In recent years, there was speculation that the authorities constrained the company from paying dividends (for whatever reason) during the time it was under trading suspension. The company was suspended from 2019 till 2022 as it had to have its accounts and business model clarified following short-seller accusations.

The company was suspended from 2019 till 2022 as it had to have its accounts and business model clarified following short-seller accusations.

Through those zero-dividend years -- FY20, FY21, FY22 -- it had a tonne of cash and continued to generate strong operating cashflow.

While it did not pay a dividend, it did something extraordinary in 2022 not related to its operations: It paid out $140 million to buy back shares from minority shareholders under 2 rounds of "equal access offers".

This was while the stock was still under trading suspension, so it was a way out for shareholders who didn't like the uncertainty over when, if ever, the stock would trade again. It can be argued that the "equal access offers" do not equate to shareholders (who stayed on and did not sell out) benefiting directly as they would via cash dividends.

It can be argued that the "equal access offers" do not equate to shareholders (who stayed on and did not sell out) benefiting directly as they would via cash dividends.

But from another perspective, the "equal access offers" equate to a big budget on non-operational matters and, more relevantly, they reduce shares outstanding.

Bottomline, there's a bigger pie for shareholders who chose to stay on with the company.

This argument among shareholders has gone on for a long time in social media forums.

It will be water under the bridge when Best World reports its FY2023 results wherein it will declare or not declare a dividend payout.

If it doesn't, why not? To its credit, Best World, in fact, had been handing out dividends consistently annually pre-suspension in 2019.

Plain truth is, it is able to pay. And its operating cashflow is strong.

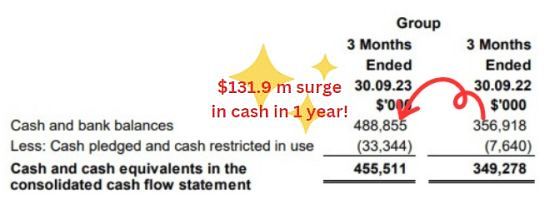

As of end-3Q2023, Best World was sitting on $488.9 million cash. It's quite a pile that would have grown in 4Q.

It had 432.5 million shares outstanding, which means a 2-cent dividend (for example) will amount to only $8.65 million.

For a 4% yield, a decent but unremarkable yield, the dividend will have to be ~7 cents a share, translating to $30 million in total.

By the way, the current market cap of Best World (stock price: $1.79) is $774 million.

Ex-cash, the operating business is valued by the market at just under $300 million -- even though it generates profit in excess of $100 million a year.

Doubtless, investor sentiment could turn more positive if a dividend is declared soon.