Q: Can you share about your (original design manufacturing) ODM business?

Mr Ho: We acquired a design centre from Motorola. For the first two years, the design centre was under obligation to serve only Motorola. Since last year, we started our ODM business and acquired a few more customers in addition to Motorola.

We have ventured into different segments of ODM. Now, we do not only design handsets, but are also venturing into designing lifestyle products. One product we recently launched was the 360-degree camera. It was designed and manufactured by our ODM team.

Another area we are venturing into is Internet optics. Today, electronic appliances in the home are becoming more intelligent. This area is our core strength – that is, putting wireless modules into home electronics products. This is another major segment that we are pursuing.

We saw very healthy growth last year for the entire ODM segment and we will continue to see growth for the year ahead.

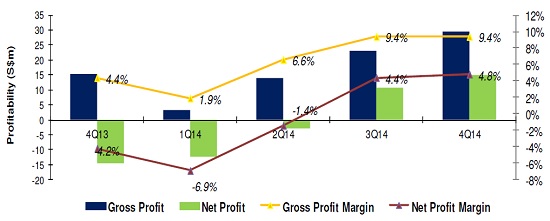

Hi-P expects to post a net loss in 1QFY2015. The good news is: It expects FY2015 revenue and net profit to exceed FY2014's.

Hi-P expects to post a net loss in 1QFY2015. The good news is: It expects FY2015 revenue and net profit to exceed FY2014's.

Q: Why are you expecting a loss in 1QFY2015?

Mr Yuen: We had some start-up costs for our Nantong plant, which will commence operations this March. Before that, in January and February, we will incur labour cost for workers who are testing the machines. We also have some fixed and semi-fixed costs such as asset depreciation. We are expecting to incur a few million dollars of losses.

The loading during 1QFY2015 will be relatively low due to cessation of work during Chinese New Year celebrations. The first quarter is seasonally tougher because of this.

We are expecting new orders during the second quarter. This is for new project with an existing client, with order ramp up only in the second half of Q2.

Mr Yao: Without the burdens mentioned by Samuel, we would have been profitable in 1QFY2015.

Recent story: Negative Profit Guidance: SPACKMAN, HIAP HOE, Hi-P INTERNATIONAL