|

|

Rising competition in healthcare

Competition in nitrile healthcare gloves is expected to stiffen this year on a 17% influx of capacity for 19b gloves by the Big-4 glovemakers and Riverstone. Any excess capacity could depress ASPs and margins, especially if a price war breaks out.

Still, we think providers of differentiated products and more efficient players with strong take-up for their new capacity can continue to thrive. Some 50% of Riverstone’s healthcare gloves are differentiated and its new capacity has been fully taken up.

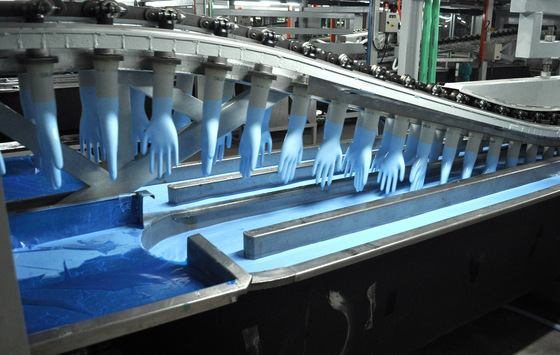

"ASPs for cleanroom gloves should be resilient due to benign competition," says Maybank Kim Eng. NextInsight file photo.

"ASPs for cleanroom gloves should be resilient due to benign competition," says Maybank Kim Eng. NextInsight file photo.Mitigated by strong USD, subdued material prices

Although rising competition could trigger ASP declines, we believe a stronger USD and benign input prices could mitigate any margin squeeze.

To reflect a generally more challenging environment, we already incorporated an ASP decline of 3.5% for healthcare gloves for FY15E. ASPs for cleanroom gloves, on the other hand, should be resilient due to benign competition. This segment is expected to account for 66% of FY15E gross profit.

Maintain BUY

Riverstone’s 13.8x FY15E EPS trails peers’ 16x average, although it has the strongest EPS growth prospects. Maintain BUY and SGD1.21 TP, at 15x FY15E EPS or a slight discount to peers.

Recent story: RIVERSTONE: Ramping up production by 1 billion gloves a year (+31% y-o-y)