'Portuser' contributed this article to NextInsight Production of rubber accelerators @ China Sunsine's plant in Weifang. The company's environmental protection measures have enabled it to win market share from pollutive peers which were shut down last year by the local authorities. NextInsight file photo.

Production of rubber accelerators @ China Sunsine's plant in Weifang. The company's environmental protection measures have enabled it to win market share from pollutive peers which were shut down last year by the local authorities. NextInsight file photo.

Background: RUBBER ACCELERATORS are chemicals that shorten the time taken by sulphur to improve the physical properties of rubber in a process known as vulcanisation. The main users of accelerators are tyre companies which consume the bulk of global rubber output (both natural and synthetic).

The majority of accelerators are made from MBT, a low-grade accelerator. China produces around 70% of world’s rubber accelerators.

The production of MBT generates large amounts of wastewater. When the Chinese Government stepped up checks in 2014 and closed down polluters, the price of MBT surged RMB2,700 (VAT-exclusive) in the 2nd quarter to reach RMB 17,200, driving up prices of accelerators that use MBT as a feedstock.

|

With its strict pollution control measures, Singapore-listed China Sunsine, the world’s largest accelerator producer with 17% of global output, has been able to produce MBT without interruption.

The company's performance has been good: RMB 83m profit was achieved in the third quarter of 2014, against RMB 77m for the whole of 2013:

However, checks show that MBT lost all its gain in the last two months of 2014.

Prices of MBT-based accelerators, excluding TBBS, fell too.

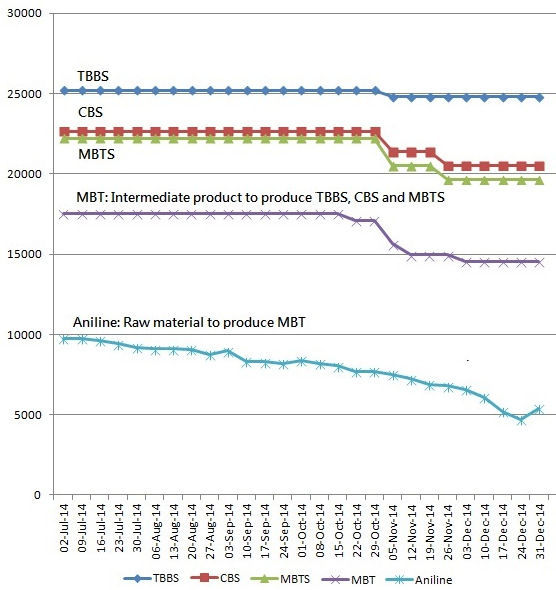

The following chart displays the price trends for various types of accelerators -- TBBS, CBS, MBTS and MBT -- sold by 山东斯递尔化工科技 in the second half of 2014 as well as the price trend of aniline (the main raw material that made up 30% of Sunsine’s production cost in 2013):

Accelerator prices have declined in 4Q2014 but this have been more than compensated by sharply lower input costs of aniline.

Accelerator prices have declined in 4Q2014 but this have been more than compensated by sharply lower input costs of aniline.

Data source: http://zgxcl.oilchem.net/x/p_281_110_553_0_1.html

@ China Sunsine: Bags of TBBS, a type of rubber accelerator which commands a high price as few companies have the requisite technology to produce it. NextInsight file photo.The price of MBT stayed at around RMB 17,500 per tonne for several months in 2H2014 before easing in Nov, and plunging to RMB 14,500 in December.

@ China Sunsine: Bags of TBBS, a type of rubber accelerator which commands a high price as few companies have the requisite technology to produce it. NextInsight file photo.The price of MBT stayed at around RMB 17,500 per tonne for several months in 2H2014 before easing in Nov, and plunging to RMB 14,500 in December.

In the short space of two months, MBT had lost RMB 3,000 and was back to where it was in the first quarter.

It is not clear whether this was the result of better supply of MBT in the market, or the plummeting aniline price as a result of the free-falling crude oil price in 2H2014, or a combination of both.

(A main raw material in the production of aniline is benzene, which is a by-product from the cracking of crude oil.)

|

Product |

3Q 14 |

4Q 14 |

Change (%) |

|

TBBS |

25,214 |

24,939 |

(1) |

|

CBS |

22,650 |

21,459 |

(5) |

|

MBTS |

22,222 |

20,757 |

(7) |

|

|

|||

|

MBT (intermediary) |

17,521 |

15,708 |

(10) |

|

Aniline (raw material) |

9,402 |

7,863 |

(16)* |

In Nov, CBS lost RMB 2,100 or 9%, and MBTS RMB 2,600, or 12%. Both are MBT-based.

However, TBBS, produced from MBT too, was an exception.

Its RMB 3,000 price gain, arising from the earlier price surge in MBT price, was only slightly dented by the subsequent price rout of the feedstock.

The reason: Unlike CBS and MBTS, few companies have the requisite technology to make TBBS.

Although the CBS price dropped 9% in Nov, its average price in 4Q was only 5% lower than in 3Q because its price was still high in Oct. The same goes for MBTS.

4Q profit likely to be resilient, thanks to TBBS

Sunsine’s 75,000-tonne accelerator portfolio comprises TBBS, CBS, MBTS, MBT, DPG and TMTD; the last two are not derived from MBT and they are insignificant in revenue and output contributions.

High-priced TBBS contributes most of the company's profit and revenue, followed by CBS and MBTS.

The price movements of Sunsine’s accelerators should not be dissimilar to the price trends in the above chart.

As the mean of the three average price decreases (ie 1% 5% and 7%) is 4.3%, Sunsine’s accelerator segment should suffer an overall price drop not exceeding 4.3% in 4Q 14.

Revenue loss in 4Q should therefore stay below RMB 20m (4.3% of 3Q accelerator revenue of RMB 457.9m).

On the other hand, cheaper aniline in 4Q would have saved China Sunsine about RMB 16m (see note 2 below). The net effect would have been a small decrease of RMB 4m from the 3Q profit of RMB 83m.

If the price movements of Sunsine’s accelerators were not dissimilar to the price trends in the above chart, and operating conditions in 4Q were similar to 3Q, the company’s 2014 net profit likely came up to RMB 245 m -- or 220% higher year-on-year.

This translates into a PE of just 4X at the recent stock price of 45 cents. (The company is expected to announce its 2014 results in a few weeks' time).

* Note 1: Sunsine carries one-month supply of aniline. Accelerators sold in a particular month are therefore produced from aniline purchased a month ago. RMB 9,402 is therefore the average aniline price between June and August, and RMB 7,863 the average between September and November.

Note 2: Sunsine disclosed in its 2013 annual report that a 10% drop in aniline price would boost profit by RMB 30m, or a pre-tax profit of RMB 40m. This means RMB 40m would be saved from a 10% price drop of aniline. Therefore RMB 400m worth of aniline was consumed in 2013.

This is Part 1. Part 2 will be published tomorrow morning: CHINA SUNSINE: What's in store in 2015?

this means that even if crude oil prices fall, there will be limited fall in aniline price. But when crude oil price recovers, then aniline price will start to climb up more significantly.