|

IN THE RECENT rights issue of Yamada Green Resources, a large block of nil-paid rights was sold by a substantial shareholder and there was a delayed disclosure of that transaction.

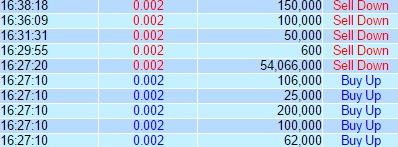

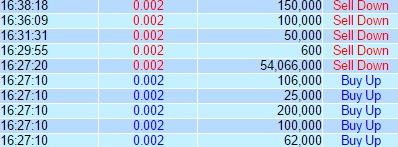

Source: Poems.The substantial shareholder, Global Yellow Pages, sold its 54,066,000 nil-paid rights. Source: Poems.The substantial shareholder, Global Yellow Pages, sold its 54,066,000 nil-paid rights.

This can be inferred from an announcement posted by Yamada on the SGX website on Tuesday (Sept 22).

The announcement said that Global Yellow Pages' stake in Yamada has now been diluted from 20% to 13.3% pursuant to the rights issue. This would have arisen from Global Yellow Pages not subscribing for its entitlement of rights shares.

The announcement did not specifically say that Global Yellow Pages sold its nil-paid rights, let alone the date of the sale.

But, given its unusually big size, the sale of the block of 54,066,000 nil-paid rights on 3 Sept caught the attention of investors.

It was very likely that Global Yellow Pages was the seller as there can be no other holder of such a big block. Global Yellow Pages was the No.2 largest shareholder in Yamada after the CEO (who had earlier pledged to subscribe for all his rights shares).

A total of 12 business days elapsed between 3 Sept and 22 Sept, when we finally learnt of the fall in Global Yellow Pages' stake to 13.3%.

This is clearly not in the spirit of timely disclosure.

Has Global Yellow Pages breached disclosure regulations relating to timely disclosure? Some people I spoke with interpret the relevant regulation as not requiring the disclosure of transactions of nil-paid rights by substantial shareholders (although this is required of directors of the company).

Thus, Global Yellow Pages probably did not breach any disclosure regulation. In fact, there have been precedents of such delayed disclosure by substantial shareholders in several rights issues of other listed companies.

This needs to be fixed. In the spirit of timely disclosure, the relevant regulation should be amended to require prompt disclosure of the sale of nil-paid rights by substantial shareholders.

Yamada's self-cultivated shiitake mushrooms are sold mainly to wholesalers in the PRC who, in turn, sell the mushrooms to restaurants, supermarkets and retailers mainly in Shanghai, Fujian, Zhejiang, Jiangsu and Guangdong Provinces, PRC. Photo: CompanyOn another matter, Global Yellow Pages could be pro-active in explaining to its shareholders the reason for its paring down its stake in Yamada. Yamada's self-cultivated shiitake mushrooms are sold mainly to wholesalers in the PRC who, in turn, sell the mushrooms to restaurants, supermarkets and retailers mainly in Shanghai, Fujian, Zhejiang, Jiangsu and Guangdong Provinces, PRC. Photo: CompanyOn another matter, Global Yellow Pages could be pro-active in explaining to its shareholders the reason for its paring down its stake in Yamada.

This stance is very different from what it was about two years ago, when it accumulated shares of Yamada from three sources -- via a share swap with the CEO of Yamada, from the open market, and from a sale by another substantial shareholder.

At that time, Global Yellow Pages had referred to its interest in Yamada as "a strategic investment into the food business which will bring substantial benefits to the Company and the Shareholders as Yamada is highly diversified by sector and geography."

It had bought the bulk of its Yamada holdings at prices which were more than 100% higher than the recent rights issue price of 7 cents apiece.

In selling its nil-paid rights at 2 cents apiece, Global Yellow Pages gave up an opportunity to acquire Yamada shares at a PE of about 2X and 0.2X book value -- which is very cheap by many yardsticks. The question is why?

|