|

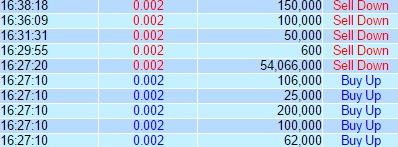

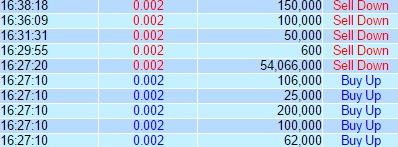

Source: Poems.1. A block of 54,066,000 nil-paid rights was transacted on Thursday afternoon (Sept 3). Was the seller Global Yellow Pages, whose rights entitlement is identical? Source: Poems.1. A block of 54,066,000 nil-paid rights was transacted on Thursday afternoon (Sept 3). Was the seller Global Yellow Pages, whose rights entitlement is identical?

Global Yellow Pages was entitled to 54,066,652 nil-paid rights for its holding of 108,133,305 ordinary Yamada shares (ie, 1 right for every 2 ordinary shares held).

Yamada founder and CEO Chen Qiuhai. Yamada founder and CEO Chen Qiuhai.

NextInsight file photo.Global Yellow Pages is the No. 2 largest shareholder of Yamada after Yamada's CEO, Chen Qiuhai.

Mr Chen owns 195,936,718 shares of Yamada which would have given him 97,968,359 nil-paid rights. And he has undertaken to subscribe for all of that.

2. Who was the buyer of the 54 million rights? It's likely to be Sam Goi, who owns 90% of Hydrex International, the No.3 shareholder in Yamada. (The remaining 10% of Hydrex is owned by Koh Boon Hwee).

Reasons for this deduction:

a) Mr Goi has expressed a clear interest in upping his stake in Yamada, as he has undertaken to subscribe (ie, sub-underwrite) rights shares not taken up by entitled shareholders. This would lead him to own, directly or indirectly, up to 26.4% of the enlarged share capital of Yamada.

Billionaire Sam Goi.That would triple Mr Goi's current 7.8% stake in Yamada. Billionaire Sam Goi.That would triple Mr Goi's current 7.8% stake in Yamada.

b) The cost of buying the 54-m rights shares and converting them into shares amount to nearly $4 million. Mr Goi has the financial resources and investment interest to buy the 54 million rights shares.

Confirmation of Global Yellow Pages and Sam Goi being the parties (or not being the parties) to the transaction will come in due course, when Yamada makes an annoucement regarding the rights subscription several days after the subscription deadline on Thursday (10 Sept) or when Global Yellow Pages/Sam Goi make the mandatory announcements on changes in their percentage shareholdings.

(Curiously, there is no listing requirement for a substantial shareholder to report promptly a sale or purchase of rights entitlements. See: RIGHTS ISSUES: Why no timely reporting by substantial shareholders?)

3. Assuming Mr Goi indeed gets to raise his stake in Yamada to 26.4%, what's his intent with regards to the company's business and listing status?

26.4% is a big stake but it does not surpass that of the CEO. Mr Goi may be a strategic partner of Yamada if there are synergies between Yamada's business and Mr Goi's food business. At the moment, that's not clear.

Or quite simply, Mr Goi is just positive about Yamada's business, and he thus would like to increase his investment in a profitable business at cheap valuations.

Or, more significantly, assuming he is on friendly terms with Mr Chen (the CEO), their stakes of 26.4% and 36.2%, respectively, could in combination smoothen the way for a privatisation of the company one day (and a subsequent relisting in another stock exchange where the PE multiples for S-chips are more decent than in Singapore).

The share price spiked up in early 2013 after it was announced that Sam Goi and Hydrex International would take up a placement of new Yamada shares at 11.9 cents each. Surprisingly, a few months later, Hydrex and Mr Goi sold about half of the shares (specifically, 42,287,000 shares) to Global Yellow Pages at more than 2X the price (ie at 27.5 cents each). The share price spiked up in early 2013 after it was announced that Sam Goi and Hydrex International would take up a placement of new Yamada shares at 11.9 cents each. Surprisingly, a few months later, Hydrex and Mr Goi sold about half of the shares (specifically, 42,287,000 shares) to Global Yellow Pages at more than 2X the price (ie at 27.5 cents each).

Chart: www.ft.com

4. What are the valuations of the company? Yamada has just reported FY15 (ended June) profit of RMB86.2 million, including a RMB18.2 million fair value gain in its biological assets.

That means, at 7.9 cents, the stock trades at a trailing PE of 2.2 and 0.2X book value. Its dividend yield is 1.7% (based on the announced FY15 dividend of 0.6 RMB cent per share).

Cheap and good?

5. Where does all this leave Global Yellow Pages? Not too good. Assuming Global Yellow Pages was indeed the seller of the 54-million nil-paid rights, it will see its stake in Yamada diluted to 13.3% from 20% currently. And it is sitting on a huge paper loss amounting to more than 50% of its cost of buying shares not just from Hydrex and Mr Goi but also from the open market.

|

Yamada's produce includes mature bamboo trees, spring bamboo shoots and winter bamboo shoots. Yamada Green Resources issued nil-paid rights recently in the ratio of 1 rights for every 2 ordinary shares. The nil-paid rights started trading on Aug 27 and ceased on Friday (Sept 4).

Yamada's produce includes mature bamboo trees, spring bamboo shoots and winter bamboo shoots. Yamada Green Resources issued nil-paid rights recently in the ratio of 1 rights for every 2 ordinary shares. The nil-paid rights started trading on Aug 27 and ceased on Friday (Sept 4).