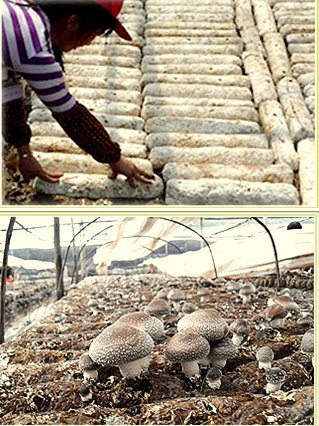

Yamada grows shiitake mushrooms on logs (top picture) made from sawdust. Photos: CompanyWHILE RETAIL investors stay away from many S-chips, a Singapore listco, Global Yellow Pages, is upping its stake in one of them -- Yamada Green Resources.

Yamada grows shiitake mushrooms on logs (top picture) made from sawdust. Photos: CompanyWHILE RETAIL investors stay away from many S-chips, a Singapore listco, Global Yellow Pages, is upping its stake in one of them -- Yamada Green Resources.

On 26 May, Global Yellow Pages bought 672,000 shares from the open market at 17.35 cents apiece on average.

This brought its total holding to 100.451 million shares, or a 20% stake in the Chinese producer of fresh shiitake mushrooms and manufacturer of processed foods.

On the face of it, its previously stated intent has finally crystallised >>> Re: GLOBAL YELLOW PAGES signals possibility of buying more of Yamada Green Resources

The share purchase may also have been motivated by the accounting objective of restoring Global Yellow Pages' stake to 20% as it was diluted after an executive director (Chen Qisheng) exercised his performance share options.

With a 20% stake, Global Yellow Pages -- a household name in Singapore as a publisher of consumer and business directories -- can equity account the results of Yamada.

The 20% stake is a sharp jump from the 3.14% that it held about 11 months ago, in July 2013. Yamada Green Resources traded recently at 17 cents, translating into a market cap of S$85.4 million. Chart: Bloomberg.Global Yellow Pages had upped its stake substantially through a purchase of part of the shareholding of Hydrex International - owned by tycoon Sam Goi and angel investor Koh Boon Hwee-- and through a share swap with Yamada.

Yamada Green Resources traded recently at 17 cents, translating into a market cap of S$85.4 million. Chart: Bloomberg.Global Yellow Pages had upped its stake substantially through a purchase of part of the shareholding of Hydrex International - owned by tycoon Sam Goi and angel investor Koh Boon Hwee-- and through a share swap with Yamada.

Aside from Global Yellow Pages, another buyer of Yamada shares of late was an independent director, Chang Feng-chang, who is also CEO of Kinsley Capital International.

Left: Independent director Chang Feng-chang bought 200,000 shares on 25 June.

Left: Independent director Chang Feng-chang bought 200,000 shares on 25 June. Right: Chew Kim Kuan was appointed Financial Controller in Feb 2014. She holds 433,000 shares.The stock trades at a discount to the Net Asset Value of 29.7 Singapore cents a share.

The trailing PE is 4.97X while the dividend yield, 1.56%.

Aside from the apparently low valuation of the stock, perhaps the insiders are confident of the long-term prospects of Yamada as well as a good set of results in the remaining quarter of the financial year ending today (30 June).

In 9MFY2014 (ended March 2014), Yamada recorded RMB85.3 million in net profit, up 23.6% year-on-year, thanks in part to the non-recurrence of the foul weather that affected the yield of its mushroom farms in FY2013.

Bolstering its bamboo business segment, Yamada recently announced the proposed acquisition of a moso bamboo plantation.

It also proposed to purchase a 19% stake in Zhangzhou Meisei Foods Co. which manufactures a wide variety of agricultural processed food products, including different types of processed bamboo shoots, pickled vegetables and other processed vegetables.

Meisei is recognized as one of the leading processed bamboo shoots suppliers in Fujian Province.

For more about the company, see YAMADA GREEN RESOURCES: Lively Q&A With The Chairman