IN JULY, we carried an analyst's report XMH: Turnaround in sight

| Stock price | 15 cents |

| 52-week range | 14.6 - 19.5 cents |

| PE (ttm) | 14.2 |

| Market cap | S$68.1 million |

| Price/book | 1.1 |

| Dividend yield | 5.3% |

Unfortunately, the expected turnaround did not manifest itself in XMH Holdings' 1QFY16 (ended 31 July 2015), mainly because of a still weak Indonesian market.

Revenue dipped 7.8% to $23.8 m while net profit, 46.9% to $743,000.

The sharper fall in net profit was due to the consolidation of the first full quarter of operating expenses of Z-Power Automation, a newly-acquired 80% subsidiary.

Z-Power joins Mech-Power, which was 100% acquired in Sept 2013, in the XMH group.

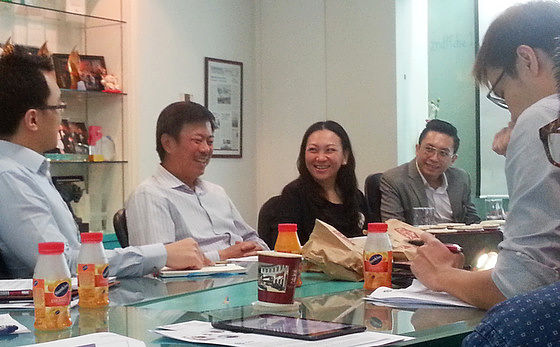

Z-Power designs and manufacture marine switchboards, remote control distribution systems and other integrated marine automation products while Mech-Power produces standby gen-sets for clients such as data centres in Singapore XMH Chairman Elvin Tan (second from left) with finance director Jessie Koh @ 1QFY16 results briefing last week. Photo by Leong Chan Teik

XMH Chairman Elvin Tan (second from left) with finance director Jessie Koh @ 1QFY16 results briefing last week. Photo by Leong Chan Teik

The following is a summary of the Q&A session at the analyst briefing last week.

The slowdown in the “projects” segment was due to which businesses? What was the improvement in the “distribution” business due to?

- The “projects” business as a whole consists of MPG and ZPA

- There was a slight decrease in this segment due to exceptionally high performance in 1Q2015

- “After sales” segment slowed due to the challenging business environment in Indonesia

- The “distribution” business increased due to the Vietnamese market

Why has the gross profit margin fallen lower? Is this a seasonality issue?

- In terms of margins, we still remain about the same

- On a normal basis, we average about 27%

- More service projects will command better margins

Assuming current revenue for all business segments, what is the normal stabilized Gross Margins for all segments?

- It depends on delivery of projects and new contracts

- We are trying to tighten our costs and 27% seems like a realistic average margin

- In good times it can be above 30% and in bad times it may be lower

There was a big jump in operating expenses, how much higher do we expect this to go?

- There were no major one-off items this quarter, so 1Q2016 operating expenses are a good reflection of what to expect

- On a normalised basis, we are looking at about S$21 million.

@ Mech Power's factory in Johor where it produces standby gen-sets for clients such as data centres in Singapore.

@ Mech Power's factory in Johor where it produces standby gen-sets for clients such as data centres in Singapore.

NextInsight file photo.How successful have the new acquisitions been so far?

- There have been referrals and collaborations between the segments and more cross selling

- MPG has given ZPA a few contracts and ZPA itself has started to direct tender as well

- They are starting to work as a team

- The monthly margins look healthy

How long does the S$6.9m profit guarantee for MPG last?

- It was for 2 audited periods ended 31 Mar 2014 and 31 Mar 2015

- Going forward, MPG still has consistent flow of orders

Are any of the business segments loss making?

- No, they are all profitable

- If there was no amortization, the results would have been much better

Do you expect MPG to pick up over the next few quarters?

- Second and third quarter orders should come into play fairly soon

- It should be able to recognise slightly better results

What is the main market for the Group now? How is the business in Vietnam?

- It is still Indonesia but Vietnam has picked up

- Currently Vietnam contributes more than S$5 million in revenue

- At the current growth rate, Vietnam might just overtake Indonesia one day

- The sales there is more on generator set sales. We have tried industrial sets but because of the abundance of cheaper Chinese brands, it is difficult to penetrate that market

- On the Indonesian side currently there is slower demand for tugs and barges

- However, there have been more enquiries on marine vessels, oil tankers, coastal ferry etc

- Maldives has also contributed some sales

How many employees? Why are staff costs so high?

- ZPA has about 100 employees

- MPG has about 110 employees

- XMH has about 70 employees

- A large part of it is salaries and corporate expenses

- S$1.2 million legal fees for expenses in FY2015 was non-recurring

- We also recognized amortization of about S$700,000 for MPG and S$100,000 for ZPA in FY2015. Last year, excluding the one-time legal fee of $1.2 m, operating expenses totalled $20 m.

Where are the stock options vested? Are these affecting the share price? Is the option price lower than market price?

- There is a 2 year vesting period before employees can exercise their options

- After which, the employee can exercise their option between the end of the second year to the fifth year

- This started when the company first listed. It is meant to allow the staff to grow with the company

- Prices are roughly at a discount to the market

- So far it has been a small amount of about 5 – 6 million options issued and about 2 - 3 million exercised so far

- It has not affected the trading of the share prices much

What happens to the (Mech-Power) factory in Johor Bahru should there be any problems for the country?

- We own the factory in JB

- Instalments and expenses have been reduced due to the weaker ringgit

- Should there be any problems or social unrest, our new factory will have the capabilities to pick up the slack

|

How much liquidated damages are expected?

What are you plans for the current premises? What is the book value?

|

The Powerpoint presentation slides for the briefing are here.