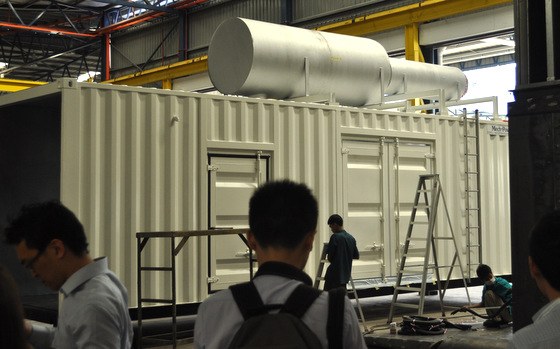

Excerpts from analyst's report @ Mech Power's factory in Johor: A very large standby gen-set being built.

@ Mech Power's factory in Johor: A very large standby gen-set being built.

NextInsight file photo.

|

|

» Surging Vietnam sales offset Indonesian weakness. XMH’s distribution business was c.29% weaker at the topline due to the political situation in Indonesian, prompting customers to delay taking deliveries. This was offset by its efforts to develop the Vietnamese market, which are now paying off with higher sales volumes amid a boom in building fishing vessels as the locals eschew vessels built in China.

» Mech Power Group (MPG) and Z-Power to drive a turnaround. MPG delivered SGD43m in revenue and SGD3.3m in profit in FY15. We expect c.20% topline growth in FY16 to SGD52m, with high demand for back-up generators in Singapore as more data centres and new buildings (eg Changi Airport Terminal 4) are built. Z-Power surprised on the upside with a 38% gross margin, contributing a solid SGD0.9m profit with just a 2-month consolidation. XMH fortuitously enjoyed a surge in recognitions from projects delayed until after the Z-Power acquisition was complete.  Alphonsus Chia, deputy CEO of XMH Holdings.

Alphonsus Chia, deputy CEO of XMH Holdings.

NextInsight file photo.» Solid yield. XMH declared a 0.8-cent DPS for FY15, mindful of the cash required to complete the new factory in Tuas (incidentally, the late completion of the building will likely result in some liquidated damages payable to XMH, in our view).

The turnaround in PATMI and cash flow should offer support for the dividend rebounding to the 1.1-cent to 1.3- cent range, which translates into a 50-53% payout ratio vs 66% this year.

» Maintain BUY, with a lower SGD0.25 TP. Analyst Lee Yue Jer will assume coverage of the stock. Our TP is based on 12x (from 10x) FY16F P/E with a recovery in sight, backed by solid cash flow and a 15- 17% ROE (12-15% ROIC). Key risks are sustained weakness in the Indonesian market and start-up issues with the new facility.

Full report here.