@ 2Q results briefing: Mermaid Maritime finance director Phiboon Buakhunngamcharoen (in tie) and executive vice-president (investor relations) David Ng. Photo by Leong Chan Teik

@ 2Q results briefing: Mermaid Maritime finance director Phiboon Buakhunngamcharoen (in tie) and executive vice-president (investor relations) David Ng. Photo by Leong Chan Teik

2Q15 was a strong one for Mermaid Maritime, which is surprising compared to the performance of other oil & gas service companies.

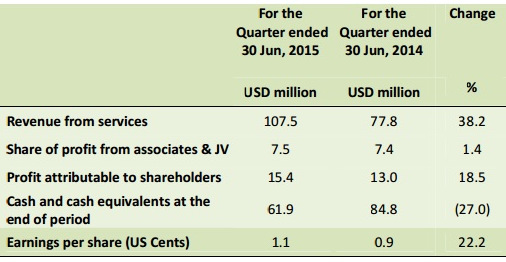

Revenue was US$107.5 m, up 38.2% y-o-y, while net profit was US$15.4 million, up 18.5%.

Reason: 79% of revenue came from IRM (inspection, repair, maintenance) work on oil-producing assets at sea. IRM is classified under the 'sub-sea' segment.

"Think of us as a repairman for your building. You need us to be on standby, to fix things when things go wrong, to ensure that everything is in tip-top condition," as David Ng, V-P for investor relations, told an analysts' briefing last week.

The IRM work continues on production platforms as these are generating revenue for the oil producers. Where Mermaid operates -- Southeast Asia and Middle East -- the cost of oil production is low as these are shallow waters.

Customers are not overly sensitive to IRM costs as these are a small percentage of total operating expenses of the production assets, noted Mr Ng.

Customers don't want to change IRM contractors, which could affect their work schedules and involve the risk that the new contractor may be of lower quality.

The IRM business returned to normal compared to the loss-making 1Q2015 with the resumption of services of three of Mermaid's largest vessels for subsea work after they were dry-docked in 1Q for the requisite surveys for sea-worthiness.

Mermaid's IRM business which utilises a fleet of 10 vessels saw a 3% increase in revenue y-o-y in 2Q2015.

"Contrary to the experience of other operators, who are not in the IRM business, we are seeing more business and we can charge more," said Mr Ng.

The remaining 21% of 2Q revenue came from cable-laying on the sea-bed. Here there is positive news too -- this is a new business (less than a year old) that suffered 2 quarters of losses and then turned profitable.

Cable laying is a related business for IRM contractors -- and Mermaid has several cable-laying customers who are its IRM customers too.

Mermaid's 2Q profit would have been even better if not for an accounting treatment whereby a tender rig of Mermaid (MTR-2) was reclassified from 'asset for sale' to 'fixed asset'. |

The Powerpoint materials for the results briefing can be found here.