| • Mermaid Maritime's stock has done well with a year-to-date rise of 50%, from 9.9 cents to 14.7 cents. It's up 100+% over the past 12 months. • Investors are giving due recognition to its large orderbook, in addition to the strong emergence of a business segment -- decommissioning of ageing oil & gas infrastructure out at sea. We highlighted this new business a week ago in MERMAID MARITIME: Stock's up 70+%, driven by a sunrise business within the oil & gas sector  • And now UOB Kay Hian's unrated report is positive on the Singapore-listed, Thailand-headquartered company (market cap: S$208 million) and adds further insights into the prospects. Read more below... |

Excerpts from UOB Kay Hian report

Mermaid Maritime (MMT SP)

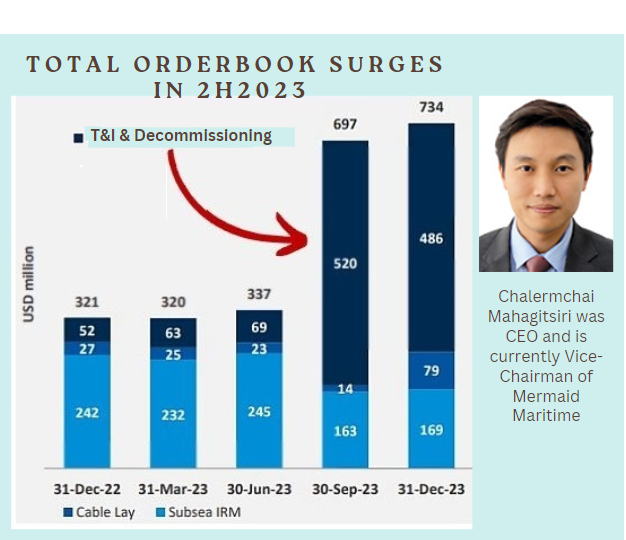

MMT’s subsea and offshore services market has traditionally been in Asia; however, it has successfully expanded into the Middle East, West Africa and the North Sea in the past few years. Profitability has grown materially over the past three years with management guiding for EBITDA margin expansion in 2024 and 2025. In 2H23 alone, the company doubled its orderbook to finish 2023 at US$734m. |

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

• Improving margins due to higher utilisation. During our recent meeting with management, it appeared very confident that EBITDA margin can continue to expand in 2024 helped by higher charter rates, continued high vessel utilisation rates and supported by a robust orderbook.

In addition, the company noted that its low-margin contracts from 2021 and 2022 have been completed as at end-23, and all new contracts from 2024 onwards should experience higher dayrates.

• MMT’s orderbook doubled in size in 2H23 from US$337m to US$734m (as at end-23) due to, among others, a significant contract from Chevron Thailand for decommissioning work in the Gulf of Thailand.

MMT has said that this will likely underpin its revenues for the next few years. Apart from this, the company also won contracts in Southeast Asia, the Middle East, the North Sea, and the Western Sub-Saharan region.

• Solid balance sheet with support from major shareholder. In Feb 24, MMT secured a US$55m shareholder loan from its major shareholder Thoresen Thai Agencies at below market rates. As a result, the company estimates that its present net debt to equity is 0.6x.

| • Outlook. Management has guided for stronger revenues and profitability in 2024 and 2025 on the back of higher dayrates as old contracts roll over and new contracts start, sustained high utilisation levels and continued strength in new order wins. Industry expectations for oil prices in excess of US$80/bbl levels should underpin this growth. • Key risks to the stock appear to be low daily trading liquidity, a decline in the oil prices which could impact spending in the offshore oil and gas industry, and operational risks. |

Full report here.