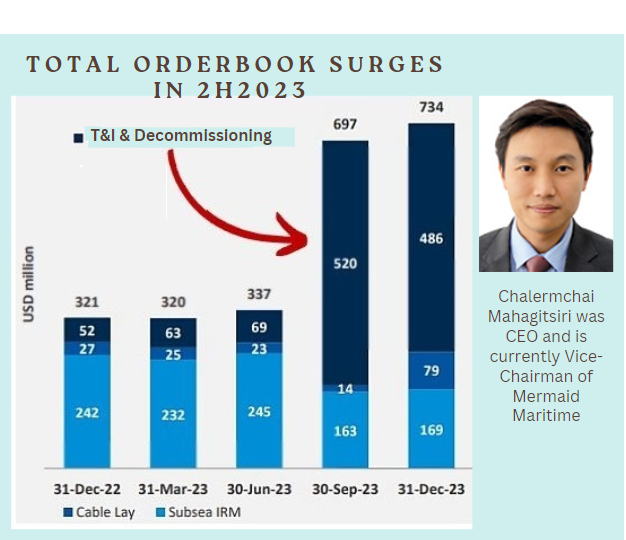

| • Mermaid Maritime's stock has done well with a year-to-date rise of 100%, from 9.9 cents to 20 cents. • Lim & Tan Securities' newly-released initiation report says there is more upside ahead as charter rates for Mermaid's fleet stay elevated. In addition, there is a new growing business for Mermaid -- decommissioning of ageing oil & gas infrastructure out at sea. We highlighted this in March 2024: MERMAID MARITIME: Stock's up 70+%, driven by a sunrise business within the oil & gas sector This chart below from Mermaid shows that its orderbook surged in 2H2023, largely due to decommissioning work:  • In the chart, T&I refers to Transport & Installation, which relates to work for new topsides and pipelines. Decommissioning is obviously to do with old topsides and pipelines. • Lim & Tan's report lends further reason for a rise in the stock of the Singapore-listed, Thailand-headquartered company (market cap: S$282 million). Read more below... |

Excerpts from Lim & Tan Securities report

Analyst: Nicholas Yon

Mermaid Maritime (MMT SP)

| We initiate a “BUY” recommendation on Mermaid Maritime ($0.19, down 0.5 cent) with a target price of $0.30 based on 12.5x FY24PE, pegged to 15% discount to its peers. MMT boasts one of the world’s largest DSV (Diving Support Vessel) fleets and is a turnaround company strategically positioned to capitalise on the rising demand for decommissioning and IRM (inspection, repair & maintenance) projects amidst higher oil prices and global sustainability initiatives. With high operating leverage due to their big fleet size amidst an industry upcycle, MMT has hit critical mass, and we expect further increases in revenue to significantly contribute to their bottom line. |

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

The market has not yet fully acknowledged MMT’s robust momentum in securing orders, promising significantly increased revenue and profit visibility in FY24 and FY25.

| Mermaid Maritime | |

| Share price: 20 c | Target: 30 c |

The O&G downturn for the past seven years has also eliminated several of MMT’s competitors.

MMT has one of the largest and skilled dive teams and is thus positioned to secure delayed projects which are just resurfacing.

Due to the scarcity of DSV vessels and elevated charter prices, MMT now has pricing power.

Increase in decommissioning projects. With numerous oil wells expecting to cease production in the next decade across APAC/Thailand, MMT is a prime beneficiary of the expected increase, as evidenced by its surge in decommissioning orders.

"We expect MMT’s win momentum to continue and the order book to cross S$1bln, giving further visibility beyond FY24." |

Projects have a short life span, and MMT will have a 60%-65% current order book recognised in FY24. This excludes further contract wins.

Order book winning momentum. Despite more than doubling its order book in 6 months from US$337mln in 1HFY23 to US$734mln, MMT has continued to secure multiple contracts across SEA, the Middle East and Africa to replenish its order book.

We expect MMT’s win momentum to continue and the order book to cross S$1bln, giving further visibility beyond FY24.

Rise in OSV charter rates. With an extensive fleet, the operating leverage MMT that has worked against them in the past has now reversed as charter rates continue to soar.

Charter rates are now near 2008 high, and any rate increase above MMT’s cost structure directly feeds into MMT’s bottom line.

Older contracts entered before FY23 should also expire soon, and any new agreements made should reflect the higher charter rates seen in today’s market.

Undemanding valuations. Despite the spike in share price, MMT’s valuations continue to be undemanding and trade at 8x forward PE.  Nicholas Yon, analystGiven our expected net profit of US$25mln for FY24, we value MMT at 12.5x PE by applying a 15% discount to peer estimates PE of 14.7x due to its small-cap nature. Nicholas Yon, analystGiven our expected net profit of US$25mln for FY24, we value MMT at 12.5x PE by applying a 15% discount to peer estimates PE of 14.7x due to its small-cap nature. We also look forward to a dividend surprise, which can be well supported by MMT’s current operating cash flow. Mermaid’s market cap stands at S$268.5mln and currently trades at 8x forward PE and 1.1x PB. Our target price stands at S$0.30. |

Full report here.