OTTO MARINE has done relatively well in a harsh environment, narrowing its net loss in 2Q2015 to US$2.5 million (1Q2015: US$13.3 million), thanks to new chartering contracts worth US$132.2 million secured during the quarter.

The new contracts also lifted order book to US$307.2 million as at 30 June 2015.

Group CEO Michael See. Photo: Company“We made great efforts to secure new chartering orders, improved our utilization rate and avoided costs that idle vessels would incur,” said Group CEO Michael See.

Group CEO Michael See. Photo: Company“We made great efforts to secure new chartering orders, improved our utilization rate and avoided costs that idle vessels would incur,” said Group CEO Michael See.

New chartering contracts, plus a reduction in fleet size lifted utilization rates to 74.0% for 2Q2015 compared with 59.2% in 1Q2015.

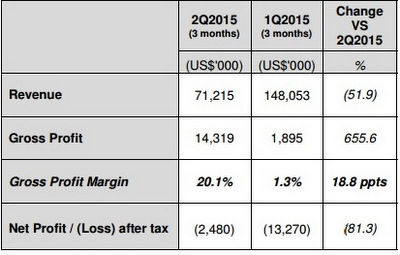

The reduction in fleet size, lower charter rates, and as well as a decrease in ship conversion revenue resulted in lower 2Q2015 Group revenue of US$71.2 million, a 51.9% drop compared with 1Q2015 and a 36.4% drop compared with 2Q2014.

“We enjoyed better margin from our owned vessels, and lowered our costs for chartered-in vessels by negotiating with the owners for contract tenures that are co-terminus with our charterers’ required tenures. This freed up our resources to charter in other technologically advanced vessels that bring in immediate contracts in response to charterers’ request," said Mr See.

“Australia has remained a stable market for chartering, supported mainly by LNG projects. In the North Sea, we maintained a reasonably healthy utilization rate for our fleet (mainly the larger DNV-class vessels capable of operating in deep water). Latin America and Africa markets see better performance than Asia,” he added.

Quarter on quarter improvement Group gross profit increased by 655.6% q-o-q to US$14.3 million in 2Q2015 due to lower cost of sales. Gross profit margin improved from 1.3% in 1Q2015 to 20.1% in 2Q2015 accordingly.

Group gross profit increased by 655.6% q-o-q to US$14.3 million in 2Q2015 due to lower cost of sales. Gross profit margin improved from 1.3% in 1Q2015 to 20.1% in 2Q2015 accordingly.

Selling and administrative expenses were reduced by 9.7% q-o-q to US$7.3 million, following the implementation of pay cuts, headcount reduction and other cost rationalization measures. Finance costs increased from US$8.1 million in 1Q2015 to US$9.2 million in 2Q2015 due to increased vessel ownership.

Its shipyard segment remained profitable in 1H2015.

Deep Sea 1 is an AHTS vessel on Otto Marine's chartering fleet. Photo: Company

Deep Sea 1 is an AHTS vessel on Otto Marine's chartering fleet. Photo: Company