• Riverstone Holdings' 1Q23 net profit from manufacturing and selling gloves was decent at RM47m (S$14m). Never mind that it is a sharp 57% fall from the same quarter a year ago when the pandemic was demanding lots of healthcare gloves.

• Riverstone continued to generate strong operating cashflow (1Q2023: RM59 million), which sets it up for continued dividends this year. When asked about its use of cash during an earnings call yesterday, CEO Wong Teek Son's answer was music to the ears of investors.

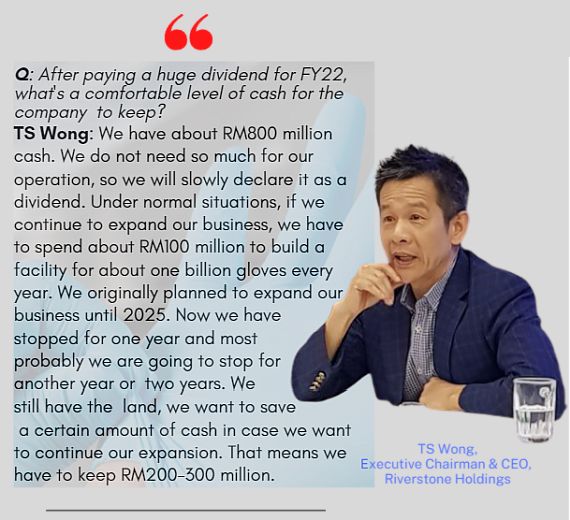

• Basically, he said Riverstone would return cash that is in excess of its modest capex needs. See the Q&A content below:

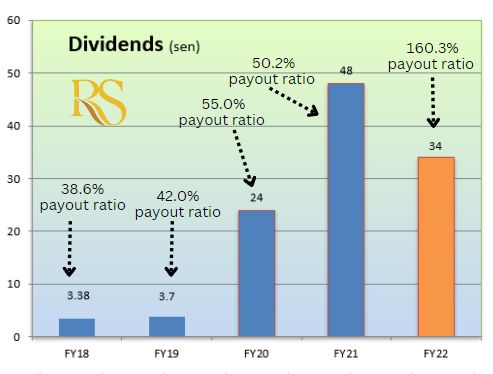

Whopper of a dividend in FY2022

Whopper of a dividend in FY2022

Below are excerpts from a CGS-CIMB report following the earnings call yesterday.

Analyst: Ong Khang Chuen, CFA

Riverstone Holdings: Earnings likely bottomed in 1Q23

■ 1Q23 net profit of RM47m (+11% qoq, -57% yoy) was slightly ahead of expectations, helped by non-recurrence of forex loss and a lower tax rate.

■ Reiterate Hold as path to earnings recovery remains uncertain. RSTON looks to continue distributing the excess cash on its balance sheet to shareholders. |

||||

| 1Q23: Surprise qoq improvement in net profit |

Riverstone Holdings’s (RSTON) 1Q23 net profit of RM46.7m (+11% qoq, -57% yoy) was slightly ahead of our expectation at 31% of our full-year forecast.

While net profit showed qoq improvement, we note that this was mainly due to 1) non-recurrence of forex loss, and 2) a lower tax rate; RSTON's revenue remained flattish (+1% qoq) while GP declined further to 26% in 1Q23 (4Q22: 30%) due to weaker cleanroom margins.

Utilisation improved slightly on a qoq basis to c.60% in 1Q23 (4Q22: c.55%).

| Earnings likely bottomed |

RSTON expects largely stable performance in 2Q23F, with volumes and ASPs for both its healthcare and cleanroom segments holding flattish qoq.

|

Resilient cleanroom biz |

|

"RSTON believes the ASPs for its cleanroom segment are likely to remain resilient at c.US$100 per 1k pieces in 2Q23F." |

For the healthcare segment, we think industry ASPs have bottomed after quarters of decline – RSTON successfully hiked its selling prices in Apr and May by US$0.50-1.00 per carton to pass on the higher production costs YTD.

It also put in efforts to grow the orders of its higher-priced specialty gloves, which are usually in smaller order volumes and require nimble manufacturing capabilities.

Meanwhile, RSTON believes the ASPs for its cleanroom segment are likely to remain resilient at c.US$100 per 1k pieces in 2Q23F.

While RSTON is looking to expand its cleanroom offerings into lower-end products (e.g. Class 1000 gloves), competition within this space is keener, which could limit its ability to maintain its price premium vs. peers (if it intends to pursue faster volume growth in this category), in our view.

|

Full report here