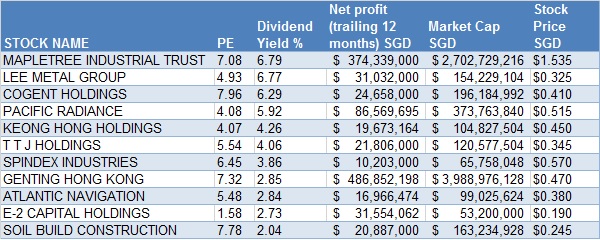

SGX-listed stocks with net profit of at least S$10 million, price earnings < 8 and paying dividends. Data: NextInsight / Bloomberg

SGX-listed stocks with net profit of at least S$10 million, price earnings < 8 and paying dividends. Data: NextInsight / Bloomberg

THE SLOWDOWN in global commodities demand, a tougher construction market, depressed oil prices and slowing GDP growth may have cast their shadow on the local stock market, but this has also made some stocks more attractively priced.

They include a structural steel manufacturer that defies the razor thin margins of the construction industry by operating a dormitory business, as well as a logistics player that gets around the limitations of land scarce Singapore by providing warehousing space in "high-rise housing".

Here are some reasons why you should consider stocks in the table above which we derived from Bloomberg, screened using three key metrics -- PE ratio, dividend and profitability.

Mapletree Industrial Trust | Dividend Yield 6.8% SG3 is a data centre at One-North that Mapletree Industrial Trust developed for Equinix, a global interconnection and data centre company routing more than 90% of the world’s internet traffic over 900 telecommunication exchanges.

SG3 is a data centre at One-North that Mapletree Industrial Trust developed for Equinix, a global interconnection and data centre company routing more than 90% of the world’s internet traffic over 900 telecommunication exchanges.

Defying the muted local stock market sentiment, Mapletree Industrial Trust’s stock price has appreciated 9% over the past 12 months to reach S$1.55.

One of the largest industrial property owners in Singapore with 84 properties valued at S$3.4 billion, Mapletree distributed S$180.8 million of its income in FY2014/2015 as dividends, up 8.9% year-on-year.

Distribution per unit (DPU) was 1.43 cents, translating into a yield of 6.8% based on a recent stock price of S$1.535.

Its DPU CAGR was a healthy 7.44% for the past 4 years, since listing in October 2010.

Even though overall rents for multi-user industrial developments are expected to ease further due to supply pressures, there are some bright spots.

» Rents for business parks and higher specification buildings are expected to strengthen on the back of a tightening in supply

» The trust manager has a strategy of maintaining a balanced mix of single-user assets and multi-tenanted buildings in its portfolio.

Single-user assets provide portfolio stability with their longer lease periods and built-in rental escalations, while multi-tenanted buildings enable the trust to capture rental upside during a buoyant rental market due to their shorter lease periods.

» In addition, the trust manager ensures that its lease expiries are well-staggered without concentration in any single year.

Lee Metal Group | Dividend Yield 6.8%

Lee Metal's facility for manufacturing reinforcement steel rebar and mesh products.

Lee Metal's facility for manufacturing reinforcement steel rebar and mesh products.

Photo: Company

Lee Metal Group trades in steel on the global market as well as supplies reinforcement steel rebar and welded mesh to the local market.

This stock is tops in its dividend yield at 6.8% as its stock price has declined some 20% in the past 12 months to 32.5 cents.

The Group is facing with headwinds in both business segments:

» China’s steel demand contracted by 3.4% in 2014, a sharp reversal from the 6% growth a year ago, and making it the first time that steel consumption dropped in 14 years.

» Its steel fabrication business has been affected by the slowdown in the local construction sector growth (from 6.3% in 2013 to 3.0% in 2014).

These two factors have affected its profitability: 1QFY2015 net profit is down 33.6% at S$4.1 million.

A change in global steel demand and a recovery in the local construction sector will revive its fortunes.

Cogent Holdings | Dividend Yield 6.3%

Cogent One-Stop Logistics Hub at 1 Buroh Crescent is the world's first and only container depot located on its rooftop. It has gross floor areas of over 1.6 million square feet and a height of 110 metres, equivalent to a 40-storey residential building. Picture: Company

Cogent One-Stop Logistics Hub at 1 Buroh Crescent is the world's first and only container depot located on its rooftop. It has gross floor areas of over 1.6 million square feet and a height of 110 metres, equivalent to a 40-storey residential building. Picture: Company

Cogent Holdings, a leading logistics player in Singapore, posted a 73% increase in 1QFY2015 net profit attributable to shareholders to reach S$5.3 million.

Its dividend yield is 6.3% based on a recent stock price of 41 cents.

With one of the largest container depots in Singapore, the Group has a fleet of more than 100 prime mover vehicles and container depot capacity to store over 20,000 TEU container units.

Other than container depot services, it also transports and stores automobiles, is licensed to de-register and export pre-owned motor vehicles as well as provides chemical logistics services.

Group revenue for 1QFY15 increased by 14% year-on-year to reach $31.0 million, driven by the following factors.

i) Warehousing revenue contribution from the newly constructed integrated logistics hub - Cogent1.Logistics Hub (Cogent One-Stop Logistics Hub), which received TOP at the end of last year.

ii) Higher demand for automotive logistics management services.

iii) Container depot service rate adjustment.

Roof-top crane infrastructure at its new logistic hub is expected to further improve its cost structure when operationally ready in phases after 2Q2015.

T T J Holdings | Dividend Yield 4.1%

T T J Holdings is a construction player with fat margins.

As at 30 April, net margin posted by the leading provider of structural steel works was 14% for 9MFY2015, much higher than other steel players such as BRC Asia (1H2015: 5%) and Lee Metal (1QFY2015 3%).

The Group’s margins were boosted by its operation of one single dormitory in Singapore (Terusan Lodge 1) with capacity for 5,300 work permit holders.

Its dormitory business contributed 13.4% to FY2014 Group revenue, mitigating the impact of lower volumes of structural steel work. T T J’s Chairman and Managing Director, Mr Teo Hock Chwee. Photo: Company

T T J’s Chairman and Managing Director, Mr Teo Hock Chwee. Photo: Company

Founder and major shareholder Teo Hock Chwee recently placed his vote of confidence in the stock even though there is currently a slump in the local construction sector.

He acquired 400,000 T T J Holdings shares on 28 April at 34 cents apiece from the open market, increasing his total interest to 67.2%.

His vote of confidence appeared to have positive impact its stock price.

The stock price rose by 5.9% to reach a recent high of 36 cents on 18 June after the Group posted 9MFY2015 net profit was down 40% year-on-year at S$9.6 million.

As at 8 June 2015, T T J’s projects order book stood at S$106 million, which it expects to substantially complete between FY2015 and FY2017.

The orderbook includes orders worth S$35 million secured in May for the provision of structural steel works for projects on Jurong Island and civil defence doors for Thomson Line.