Excerpts from analysts' report

|

|

More cash wasted on Tiger. We assume none of the other shareholders will subscribe to the rights issue, nor will other PCCS holders convert them into ordinary shares. Thus, SIA will control 71.1% of Tiger after the deal and inject SGD 247mn into the LCC.

Sharing more losses: As SIA will be the controlling shareholder of Tigerair, it should consolidate Tiger after the deal’s completion sometime in 2HFY15. We forecast SIA to share a loss of SGD 128mn and SGD 15mn in FY15 and FY16, respectively. The

losses are higher than our expectation, given the higher provisions Tiger took on aircraft lease contracts and weaker-than-expected Tiger results.

Four-brand strategy floundering: As Tiger cut its bases in the Philippines, Indonesia and Australia, it has become a LCC based only in the very competitive Singapore market with population of less than 6mn. We believe Tiger will continue to position in a small market segment different from SIA’s other three brands – SIA, Silkair and Scoot – but share the same customer base.

Neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen as the Tiger brand has been licensed to Virgin Australia and China Airlines, says StanChart. NextInsight file photo.

Neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen as the Tiger brand has been licensed to Virgin Australia and China Airlines, says StanChart. NextInsight file photo.

We now realise that SIA is unlikely to combine its two LCC brands, Tiger and Scoot, and retain only Scoot, as the Tiger brand has been licensed to Virgin Australia and China Airlines, which own Tigerair Australia and Tigerair Taiwan, respectively, for at least the next 20 years.

Thus, despite the SIA-Tiger consolidation, we believe neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen, unlike what we expected in our report, SIA exerting control over Tiger – Birth of Three Kingdoms in the ASEAN LCC universe? published on 13 May 2014.

Neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen as the Tiger brand has been licensed to Virgin Australia and China Airlines, says StanChart. NextInsight file photo.

Neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen as the Tiger brand has been licensed to Virgin Australia and China Airlines, says StanChart. NextInsight file photo.We now realise that SIA is unlikely to combine its two LCC brands, Tiger and Scoot, and retain only Scoot, as the Tiger brand has been licensed to Virgin Australia and China Airlines, which own Tigerair Australia and Tigerair Taiwan, respectively, for at least the next 20 years.

Thus, despite the SIA-Tiger consolidation, we believe neither a Tiger-Scoot brand merger nor SIA Group’s pan-Asia LCC ambition will happen, unlike what we expected in our report, SIA exerting control over Tiger – Birth of Three Kingdoms in the ASEAN LCC universe? published on 13 May 2014.

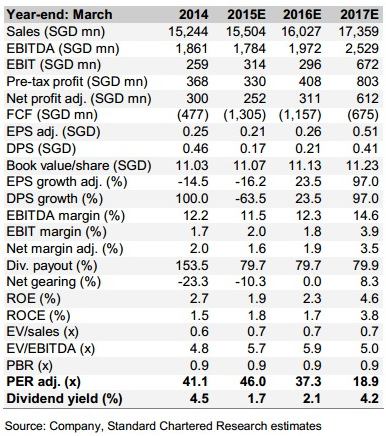

Valuation: We lower our earnings forecasts for FY15-16 on higher-than-expected losses from Tiger and weaker-than-expected passenger yield. We lower our price target to SGD 8.9 (from SGD 11.0), based on 0.8x FY15E PBR.