|

|

Ching Chiat Kwong, executive chairman of Oxley Holdings. The following analysis of Oxley was done by OSK-DMG analyst Goh Han Peng. It is incorporated into Terence Wong's article.

Ching Chiat Kwong, executive chairman of Oxley Holdings. The following analysis of Oxley was done by OSK-DMG analyst Goh Han Peng. It is incorporated into Terence Wong's article.Once in a while, a new guy comes along that re-defines the existing rules of the game and brings new perspectives to how an industry operates. Ching Chiat Kwong is one such person.

Starting out from a building contractor, Ching was one of the pioneers to introduce shoebox units to the local market on a big scale, and subsequently went on to develop fanciful industrial projects with lifestyle facilities and strata-titled mixed development projects with resounding success.

Ching was formerly a policeman who was, for a while, an otah seller, before becoming a contractor for property companies such as Macly Group and Fragrance Group.

Later on he began to develop his own projects, and in 2010, joined forces with Eric Low See Ching to form Oxley Holdings, which was listed in the same year.

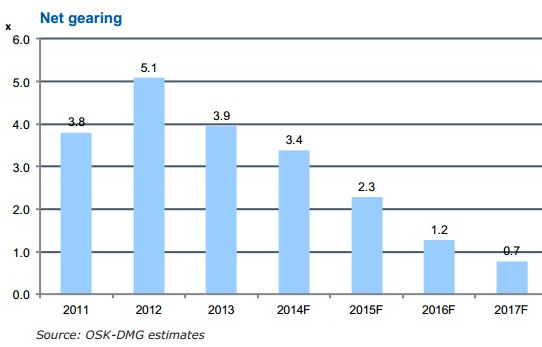

High gearing but pre-sales proceeds will bring it down rapidly

High gearing but pre-sales proceeds will bring it down rapidlyUnder accounting rules, Oxley recognises profit and revenue from commercial property sales and overseas projects only upon completion. As most of its larger projects are still in the early stages of completion, the bulk of the profit recognition will kick in from FY16 onwards.

Attractively priced.

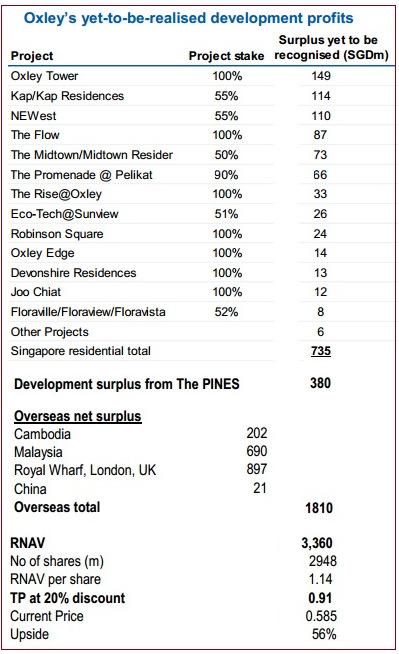

We derive a valuation of SGD1.14 for the stock based on a reappraised-net asset value (RNAV) method. At current price, the stock trades at a 49% discount to RNAV. Our TP of SGD0.91, based on 20% discount to RNAV, offers 56% upside.

Full report here.

Oxley is now only 46.5 cents.

Centurion is now only 54 cents.

How much has your MODEL Portfolio dropped?