|

|

Proposed acquisition of GAT vessel L-R: CFO Lim Kai Ching and Chairman & CEO Michio Tanamoto.

L-R: CFO Lim Kai Ching and Chairman & CEO Michio Tanamoto.

Photo: CompanyOn July 14, Uni-Asia announced that its newly-acquired subsidiary, Arena GK, would purchase a newbuilding GAT ship, which can be used for transporting construction materials within Japanese waters.

The total consideration is JPY920 million (USD9.1 million).

The seller, Minato Kaiun Co., Ltd, will bareboat charter the vessel for five years at the end of which the seller will purchase the vessel.

Uni-Asia Holdings has another business segment that deals with vessels.

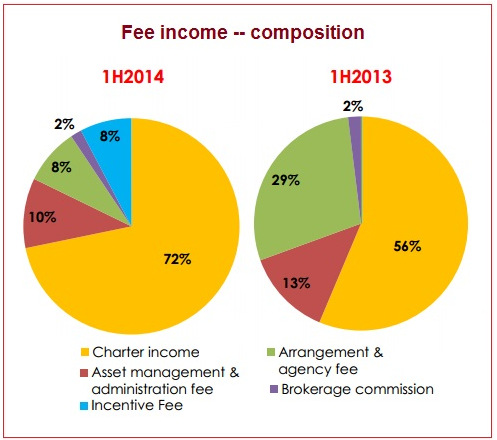

Here, it derives various fees for its services -- some recurrent, some not -- but no charter income. Uni-Asia Holdings reported US$2.71 m in net profit for 1H2014. The stock (18.9 cents) trades at only 50% of the book value.Uni-Asia, for example, can arrange financing for a ship transaction for third parties, and gets paid a fee.

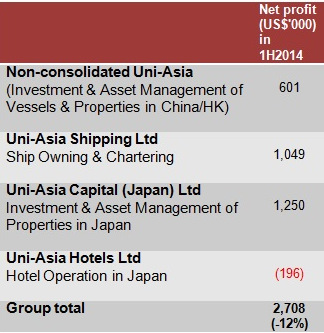

Uni-Asia Holdings reported US$2.71 m in net profit for 1H2014. The stock (18.9 cents) trades at only 50% of the book value.Uni-Asia, for example, can arrange financing for a ship transaction for third parties, and gets paid a fee.

The recurrent fees come from managing vessels which it has co-invested in under joint ventures or shipping funds.

This sort of fee will go up when three new vessels, which were ordered last year, are delivered in 1H2015, 2H2015 and 1H2016.

Including these three, Uni-Asia has minority stakes in 14 vessels for which fair value gains and losses are determined every quarter in Uni-Asia's books.

Asked about newbuilding prices of handysize bulkers, Chairman & CEO Michio Tanamoto said that they are now about 10% higher than when Uni-Asia ordered 7 vessels last year.

"Although the charter rates are still weak, newbuilding prices are not declining. Most of the handysize suppliers are Japanese yards and they are full until 2016-2017."

On the charter market, he said that rates are expected to recover at the end of this year or early next year.

Reasons he gave: The handysize bulker population is aging and many such ships will be retired over the next few years, while China's large inventory of iron ore, coal and steel products is declining and will need to be replenished (which needs bulkers for sea transportation).

Following its capital commitments for the 7 new vessels last year, Uni-Asia is "now looking for new opportunities to set up and manage JVs or shipping funds, where we don't have to put in a large amount of money, and earn recurrent income," said Mr Lim.

"We are discussing with shipyards and potential investors. From this year, this is our focus," said Mr Tanamoto.

Recent story: UNI-ASIA 1Q: Higher ship charter income, lower fee income