Kevin Scully (left) is executive chairman of NRA Capital. This article was recently published on www.nracapital.com and is reproduced with permission.

Kevin Scully (left) is executive chairman of NRA Capital. This article was recently published on www.nracapital.com and is reproduced with permission.Straco Corporation reported its Q1-2014 results which showed sustained growth in revenue which expanded by 30% but net profit declined by 1% caused mainly by the absence from gains of a land sale and exchange losses compared to exchange gains during that period.

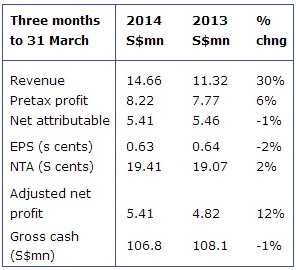

The key highlights of the results are in the table below:

Commentary:

Commentary: The group drove its top line through a 22% increase in visitors to Shanghai Ocean Aquarium and Underwater World Xiamen to 608,000.

The Group had sold a piece of land in Q1-2013 for a gain of S$0.64mn and had an exchange gain of S$0.61 in Q12013 compared to no land sale gain in Q1-2014 and an exchange loss of S$1.01mn in Q1-2014.

I have included an adjusted net profit figure only removing the land sale gains which show a profit rise of 12%.

However, if an adjustment was also made for exchange gains, the notional net profit rise would be 42% for Q1-2014.

Q1 is usually the weakest quarter for Straco Corporation in terms of revenue with Q3 being the peak.

I expect some slowdown in revenue growth to more sustainable levels in the later part of 2014.

Nevertheless, Straco is comfortably on track to deliver revenue growth of 15-20% on improved margins.

Straco generated S$6.6 million in operating cashflow in 1Q2014, up from S$5.0 million a year earlier. Above: Straco's Shanghai Ocean Aquarium. Photo: http://www.shanghai.gov.cn/

Straco generated S$6.6 million in operating cashflow in 1Q2014, up from S$5.0 million a year earlier. Above: Straco's Shanghai Ocean Aquarium. Photo: http://www.shanghai.gov.cn/The stock remains an excellent play on the domestic demand/tourism in China which does not seem to be affected by the slowing Chinese economy from weaker external demand.

The Group's strong balance sheet with gross cash of more than S$100mn can therefore continue to pay attractive dividends, reinforcing the valuation method of a divdend discount.

The stock remains attractive despite recent gains - No change in my price target (see My Stock Picks Yield section).

Recent story: Kevin Scully: "STRACO a good defensive domestic consumption play in China"